This is part two of a five-part series of Legislative Memos that Washington Policy Center offers for lawmakers to consider before preparing a statewide transportation tax increase in 2012. The five recommendations are:

- Taxes and fees paid by drivers should not subsidize other modes of transportation.

- Do not create a state-level tax or fee to fund local transit agencies — public transit is not underfunded.

- Stop diverting existing transportation taxes and fees to pay for non-highway purposes.

- Expand capacity, fix chokepoints and do not restrict new resources to just maintaining the existing system.

- Reduce unnatural cost drivers that make transportation projects more expensive.

Part II: Do Not Create a State-level Tax or Fee to Fund Local Transit Agencies

Public transportation is not underfunded in Washington state

Public transit is a local function with its own tax base and the state’s role should be limited to granting local tax authority, not creating a new state-level funding source.

A common myth among public transit agencies and the transit lobby is that they are underfunded and need state money to further subsidize transit operations.

Public transit is not underfunded in Washington state.

In fact, the final report of a 2011 state study, “Indentifying the State Role in Public Transportation,” concluded that in public transportation funding “there is no common definition of ‘unmet need’ and there is no one source of information. Many observations are anecdotal and often do not have a strong data or rationale basis supporting the unmet need observation.”

There are 31 public transit agencies in Washington and they collected $2.05 billion in total revenues in 2010. To put this in perspective, in 2010 the state collected about the same amount ($2.09 billion) from the three major revenue categories (taxes, fees and miscellaneous) that fund the state’s entire transportation budget.

Collecting more than $2 billion in a year is remarkable considering how small public transit is compared to the state’s overall transportation system. In 2010, the 31 public transit agencies provided 212 million passenger trips, or about 582,000 trips per day. The federal government estimates that households typically perform an average of 9.5 person trips per day. Washington state has 2.51 million households, which translates to an estimated 24 million person trips per day across the state. This means the 31 public transit agencies’ total market share is only about 2.4% of all daily person trip demand.

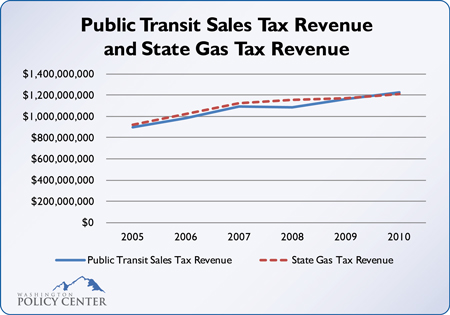

The primary funding source for the 31 transit agencies is a local option sales tax. Washington state’s primary transportation funding source is the motor vehicle fuel tax (gas tax). The following chart compares the annual sales tax revenue for public transit agencies to the state’s motor vehicle fuel tax collections between 2005 and 2010.

In 2010, the 31 public transit agencies collected $1.23 billion in sales taxes. The state collected about $1.21 billion in gas taxes in 2010. This means public transit agencies actually collected more in sales tax revenue than the entire state collected in gas tax revenue.

Among public transit agencies, the cumulative sales tax revenue since 2005 was $6.46 billion, while the state’s cumulative gas tax revenue was $6.60 billion over the same time period. Again, this is incredible when you consider how few people actually use public transit compared to the overall transportation system.

Transit officials also claim sales tax revenue is volatile and unreliable as a consistent funding source, but public transit’s sales tax revenue has grown 150% in the last ten years, from $484 million in 2001 to $1.23 billion in 2010. Inflation over the same time period only accounts for 23% of this growth. This means sales tax revenue for public transit agencies in Washington state has grown about 6.5 times faster than inflation over the last decade.

There also seems to be a misconception that transit ridership continues to rise. In reality, total ridership across the state has been steadily falling since 2008.

In 2008, transit’s annual ridership was about 222 million passenger trips. Since then however, transit demand has fallen. Through 2010, public transit’s ridership declined to about 212 million passenger trips, a drop of 4.5%. But transit’s operating expenses have gone the other way.

In 2008, total statewide transit operating expenses were about $1.01 billion. By 2010, transit’s operating expenses had risen by $53 million, an increase of about 5%. So public transit officials are serving fewer people but spending more to do it.

In another measure, public transit agencies have also accumulated very large reserve funds. In 2010, the 31 public transit agencies stored $1.81 billion in reserves, which is twice as much as they had in 2007 ($915 million). In fact, Unrestricted Cash and Investments ballooned 560% from $171 million in 2007 to $1.13 billion in 2010.

Conclusion

A transportation funding package in 2012 should not include a dedicated, state-level funding source for public transit. Transit agencies are not underfunded and they have their own tax authority. Furthermore, transit officials should learn to become more efficient before asking taxpayers for more money. The state already cannot keep pace with funding its current transportation infrastructure needs; infrastructure needs that serve the majority of daily person-trip demand. Any new transportation revenue source at the state level should be used to pay for existing obligations or to expand highway capacity; it should not be diverted to new commitments, such as public transit.

Michael Ennis is the transportation director at Washington Policy Center, a non-partisan independent policy research organization in Washington state. Nothing here should be construed as an attempt to aid or hinder the passage of any legislation before any legislative body. For more information, visit washingtonpolicy.org.

Download a PDF of this Legislative Memo here.