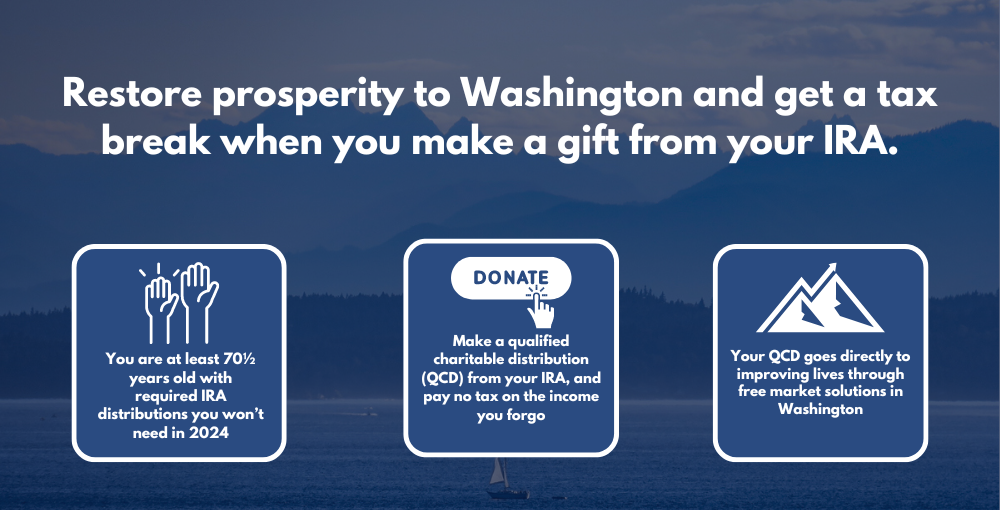

- The IRA charitable rollover provision allows supporters who are 70½ years old or older to donate up to $100,000 annually directly from their IRAs to qualified charities, such as the Washington Policy Center, without incurring federal income tax on the distribution. This presents a strategic way for you to make a significant impact on our mission while also potentially realizing tax benefits for yourself.

- By participating in an IRA rollover anytime in 2024, you can support our efforts to improve the lives of Washingtonians through common sense, free market solutions. To take advantage of this opportunity, simply contact your IRA administrator and request a direct transfer to the Washington Policy Center. Please ensure that your donation is made payable to the Washington Policy Center and that our Tax ID number, 91-1752769, is included to ensure proper processing.

- If you have any questions about the IRA charitable rollover provision or how your donation will support our work, please contact me directly at hatting@washingtonpolicy.org. We are deeply grateful for your continued support and commitment to advancing our mission.