Related Articles

A lawmaker handout to unions passed in the wee hours of the morning Feb. 13. House Bill 1893 will now move to the Senate for consideration. If the proposed legislation passes both chambers, it will allow unemployment insurance (UI) benefits to go to striking workers — even though unemployment benefits, which are provided by a tax on employers in Washington state, are meant for workers who lose jobs through no fault of their own, not for workers who choose not to work.

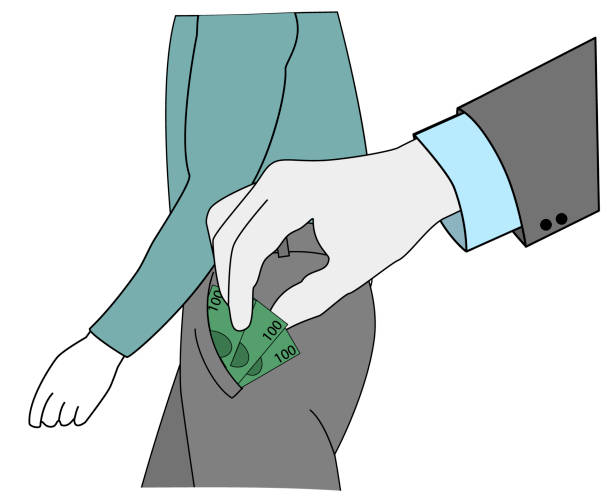

There is an old saying that laws are like sausages, and it is best not to see them being made. That saying fits House Bill 1893. This valentine to unions — that could be funded by you, me and the employer behind the tree — was not only passed largely and enthusiastically along party lines in the House, the bill had 51 Democrat sponsors. (That’s a lot and out of the norm.) Since Democrats are the usual recipients of campaign donations from unions, the “you scratch my back, I’ll scratch yours” element of this legislation seems clear. All the scratching comes at the expense of other workers in the state.

Strike funds should be funded by unions or the unionized workers who want to demand higher wages from employers offering them a living — not by employers in the state who are then left with less money to pay employees. Even though an amendment was made to try and prevent all employers from being on the hook for striker pay by increasing the tax paid by an employer with the striking workers, a cap on the employment experience factor that is used in the UI system could mean that if there is a large strike with a lot of benefits paid out, other employers could still be impacted.

Requiring employers and, by way of trickle-down, workers to pay some employees in our state for their choice not to do their jobs should offend all workers. Strikes also increase costs and services for Washingtonians.

Labor newsletters have been recruiting union members to urge lawmakers to vote “yes” on this strike fund of sorts for weeks. They are in victory mode right now. While being a proud union worker is one thing, it is quite another to force gains at the expense of your neighbors. I wish unionized workers saw past newsletter bullet points and considered how others are impacted by strikes and bills like this one.

If this legislation passes both chambers, it could lead to higher payroll taxes for other employers, even those who have nothing to do with labor negotiations. That could leave less money overall for their workers. In encouraging strikes, the legislation also could make strikes more frequent, longer and more costly for all working and nonworking Washingtonians.

This legislation ignores that strikes hurt both workers and businesses. Products and services are harder to deliver. Business finances and tax rates don’t go unscathed. A company’s reputation is often left damaged. This bill brings unfair government intervention into disagreements between employers and employees and creates a lopsided playing field that favors worker demands, not fair negotiations.

California Gov. Gavin Newsom, a Democrat, recently rejected a bill to give unemployment checks to striking workers. NPR reported in September that even though Newsom often benefits from campaign contributions from labor unions, he vetoed a bill similar to the one our state lawmakers are considering. He said his state’s fund for unemployment benefits couldn't be put at risk. The fund was going to be nearly $20 billion in debt by the end of the year.

Lawmakers voicing opposition to this strike-encouraging bill expressed concerns about creating instability in our UI fund. I can’t predict if that will happen or not, and the fund is reportedly healthy right now, but if it did, unemployment tax rates would likely rise. The state should be lowering those rates if the fund is healthy, leaving more money for job creators and their workforces.

Even if the UI fund is never in trouble because of this added encouragement to strike, it rubs many workers in the state the wrong way to have funds that are meant to keep them safe in times of job loss going to people who could be working but choose not to in hopes of being rewarded for their work stoppage. Also, our state shouldn’t toy with going even lower down in the rankings for having a good business climate. Washington state is ranked 35th on the Tax Foundation's 2024 State Business Tax Climate Index. The state is on a continual slide. We’re going the wrong way one bad tax law at a time.

Striking is not the only way to deal with an employer that an employee feels pays him or her unfairly. A worker can look for a new employer. That’s another cut from this bill: Looking for work is something that people who lose work through no fault of their own have to do in our UI system. Striking workers would be paid not to work and not to look for work.

Employers have an interest in keeping workers happy. Turnover, as well as lack of production, is costly, and reputations are important to protect.

Five Democrats joined 39 Republicans voting “no” on HB 1893, but of course that wasn’t enough in a House of Representatives dominated by Ds. Business association, employer and everyman concerns were well-voiced in discussions about the bill this last month, but they also weren’t enough. Now we’ll get to see how the Senate chooses to treat workers of all kinds, not just unionized ones.

----------

Article updated Feb. 14.

See the lively floor consideration of HB 1893 where Democrats turned down several amendments that would make the bill less offensive here: https://tvw.org/video/house-floor-debate-february-12-2024021255/?eventID=2024021255&startStreamAt=11252.