I wanted advice and guidance for employers who are wondering what to do about the unpopular, off-and-on-again WA Cares payroll tax, but what they're getting falls short.

Democratic Gov. Jay Inslee sent a letter to the Employment Security Department today directing the agency not to accept the long-term-care payroll tax from employers in advance of quarterly taxes due in April 2022. Why not follow the law that created the WA Cares Fund and a 58-cent-per-$100 payroll tax? Because the governor now sees flaws in the long-term-care law that he signed, and he wants them fixed.

The letter to ESD reads, in part: “... employers must now choose whether to begin collecting premiums on January 1, 2022 according to the current law, and returning the premiums to workers following a change in the law, or delay collection in anticipation of this legislative change. As you know, if the Legislature fails to change the law, employers will still be legally obligated to pay the full amount owed to your agency."

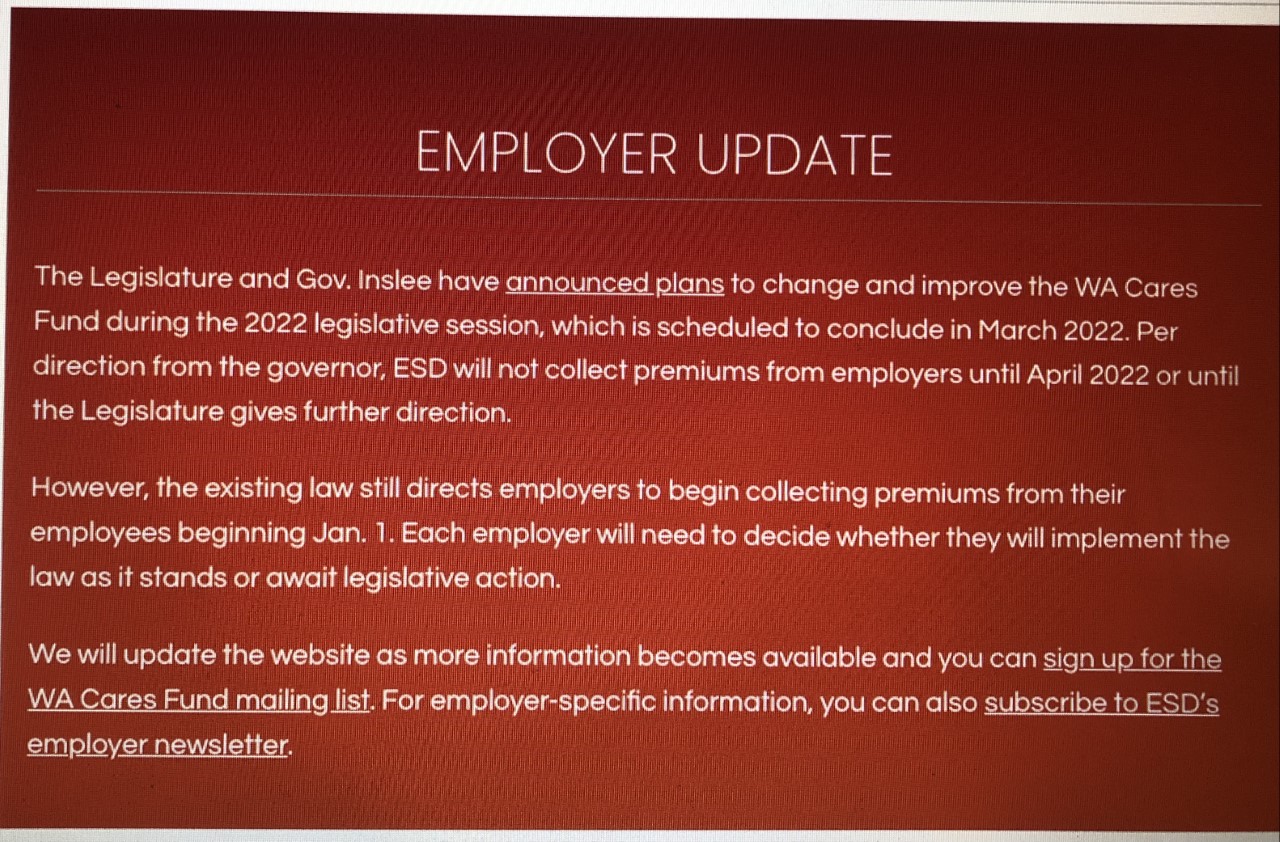

That goes along with a change on the WA Cares Fund website. An update for employers there says, “Each employer will need to decide whether they will implement the law as it stands or await legislative action.”

I read that advice as non-advice and lousy direction. Employers are basically being told, “Take your best guess and hope it works out.” And never mind the extra work and employee frustration it might cause. Sigh.

The law is broken beyond repair, and not just in need of a few tweaks. I’m aware of three different, Republican-proposed bills that would repeal the WA Cares Fund. That's the fix the governor should be working toward.