Related Articles

Relevant Topics

The Ben Franklin Transit (BFT) Board is planning to discuss tonight whether they will reduce the sales tax rate they collect to give taxpayers a break, since the agency has seen an incredible growth of 22% in sales tax revenue from 2020 to 2021, along with receiving $48 million from the federal government.

The agency is considering two options:

- Temporarily reducing the sales tax residents pay by 0.1%, of the 0.6% the agency has the authority to collect. This requires only a majority vote of the Board of Directors.

- Requesting the Benton and Franklin County Auditors to put the sales tax reduction of 0.1% on the ballot, which would permanently reduce the sales tax BFT collects to 0.5%.

Some believe that a potential outcome of this change is that the agency will no longer be eligible for state transit support grants, passed in this year’s transportation revenue package.

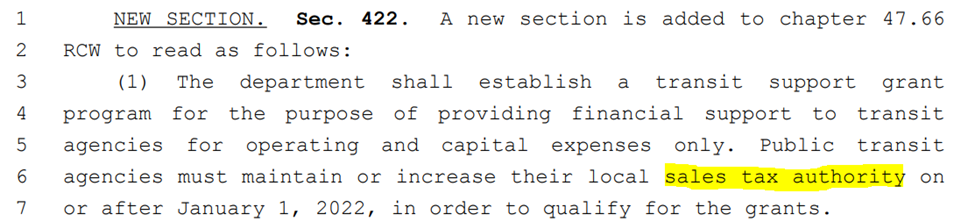

This perverse policy incentive can be found in Section 422 of the legislation, which states that “public agencies must maintain or increase their local sales tax authority on or after January 1, 2022, in order to qualify for the grants.”

BFT officials and others are interpreting this to mean “transit agencies must maintain sales tax authority at the rate that was in effect on January 1, 2022.”

I'm not a lawyer, but sales tax rate and sales tax authority are not the same thing. The law does not say anything about agencies maintaining a sales tax rate. They must only maintain or increase their sales tax authority.

Of course, transit agencies’ sales tax authority comes from the state, which can maintain, increase or reduce it. BFT's decision to temporarily suspend how much they collect in sales tax revenue would not change the sales tax authority the state has given them.

The BFT Board choosing temporarily not to collect a portion of the sales tax rate they are authorized to collect should have no bearing on their eligibility for the state grants.