A commission helping the Washington state Legislature implement its misguided long-term-care law met Monday for the first time this year.

The Long-Term Services and Supports Trust Commission was given a legislative recap, which included assurances that money had been granted for new actuarial reporting needed for the fund that was created by the law and that is supposed to be financed by a payroll tax of 58 cents on every $100 a worker makes. That fund, WA Cares, has seen nearly half a million people apply for exemption from the tax, as was allowed under a short-term, now-expired provision for Washingtonians who had private long-term-care insurance (LTCI). Their exodus could alter the game lawmakers thought they were playing.

The commission was also given a summary of two bills that passed in January: One allowed for an 18-month delay of the law and an ability for near-retirees to earn partial benefits; the other created new optional exemption categories — that add to the fund’s solvency concerns.

A list of “to-dos” also was outlined for the commission by WA Cares Fund Director Ben Veghte. During the delay, the commission is being asked to look at ways to add a re-verification requirement to people who were granted exemptions. Because legislators also just approved a way for near-retired people to earn a portion of WA Cares’ lifetime benefit if they pay in one year or more, the commission needs a way to re-enroll some who opted out.

The LTSS commission was also asked to better interpret and clarify the three-activities-of-daily-living requirement in the law and work with the insurance industry on supplemental options — a partial admission that the WA Cares Fund does not offer the “peace of mind” the state’s marketing for the fund says it does. The fund’s lifetime benefit of $36,500 is inadequate for most people with long-term-care needs.

Of interest to many Washington state residents, the commission has also been asked by lawmakers to try and develop options for people who move out of the state and won’t be able to benefit from the unportable benefit, regardless of how many years or how much money they put into the fund. I wish commission members luck. This problem was addressed by a commission workgroup last year and deemed too big of a burden on the fund to fix.

In short, the Long-term Services and Supports Trust Commission has a long list of to-dos, given how poorly designed the law was, the number of changes that have been made and its level of unpopularity among taxpayers.

I’d add to the to-do list getting all members, which include lawmakers, up to speed on what was and wasn’t available in the private market before the state disrupted it. One Democratic senator told the commission that unlike the state-imposed program that was created, you need to keep paying for private LTCI after your career years. That’s not true, though often repeated. A variety of products existed. Some did not require payments in one's retirement years.

Knowing restrictions and regulations that make insurance less affordable is another key piece of information the commission needs if the state is going to continue pitting its program against private plans, which is off-target to begin with. People fund long-term care, like other life needs, in many different ways, including with investments, savings, real estate and family help.

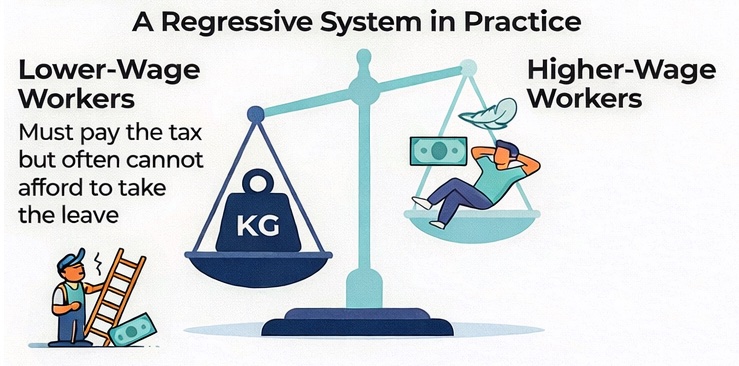

The state could play a useful role in raising awareness about this possible life need many of us will have. It should address Medicaid abuse and tax on insurance. But this law that brings a payroll tax that hurts the budgets of low- and high-income workers is in need of full repeal.

The commission’s next meeting is July 26. It will hear from a workgroup discussing supplemental LTCI and get an update on investment planning. It’s possible it will hear about the “proactive” media the state will try to obtain to create an affinity for WA Cares. A one-sided sales pitch for a law passed in a one-sided manner is sure to continue.