California is facing a public backlash over Assembly Bill 5 (AB5) that took effect January 1st to re-classify freelance workers as employees. AB5 effects job categories such as truck drivers, hairdressers, rideshare drivers and one of the most vocal groups, journalists. By changing the definition of a freelance worker, AB5 prevents an independent worker from working part-time or on a temporary contract basis. Journalists, as an example, can no longer write and submit work to different publishers; they must work for one exclusively.

AB5 has a detrimental impact on freelance workers in the state of California that its authors either did not anticipate or did not realize it would have.

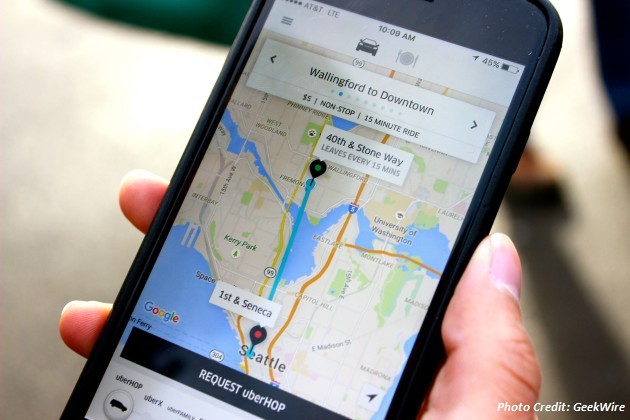

New gig-economy jobs such as rideshare and on-demand transportation companies like Uber and Lyft are significantly affected. Many drivers work part-time. They work, by choice, for multiple ride-share companies and under AB5 that is no longer possible. In response, Uber has filed an initiative this fall to exclude their drivers from the law. Additionally, there are several additional lawsuits that have been filed by others against AB5, including the trucking industry.

The estimate is AB5 will put 450,000 independent workers out of work.

Despite the problems with AB5, legislators in Washington State filed their own version of the troubled legislation. Senate Bill 6276 is an attempt to bring similar, bad employment law to Washington State. It will bring the same job killing restrictions, and presumably, a public outcry akin to the response we saw from hairdressers in 2019.

Proponents of the legislation say that it will give the temporary worker the same protections and rights as a full-time employee has today. However, that’s not how it turned out in California. Hundreds of thousands of jobs appear to have been eliminated as a result of AB5 becoming law. SB 6276, in a similar fashion, restricts a worker from choosing to work as a part-time contractor. Many workers don’t want or need full-time employment and the government should not be deciding what jobs they can and cannot accept.

The employment hiring process for employees is often more in depth than the hiring process for independent workers and freelancers. The increased cost in hiring a full-time employee is due to the commitment by the employer to the employee to provide benefits and job certainty. With the additional requirements under SB 6276, including adding the right to sue an employer through Labor and Industries at taxpayer expense (the right to sue directly already exists) and the requirement of a bond for temporary workers, the cost to the employer will go up. This will translate into reduced wages for the temporary worker or higher prices for goods and services.

Minimum wage is applied to temporary workers, again increasing the cost to the employer. For temporary workers in areas outside Puget Sound, this increase in wage rate will increase the cost to hire the temporary worker. As we have seen in Puget Sound, employers will either choose to lay off employees or not hire temporary workers.

SB 6276 also allows an independent worker to collectively bargain with the employer which will remove competition in contract bidding. Once a class of independent workers has standardized contract rates, the cost of goods and services will go up. This additional cost will be passed onto the consumer and result in less temporary jobs being available.

Thankfully, it appears that SB 6276 bill has failed to move forward to a full vote in the Washington legislature this year, but as they say, a bill isn’t ever dead. Freelancers and independent workers need to be vigilant now and in coming legislative sessions and watch out for job killing bills like SB 6276.