Related Articles

Relevant Topics

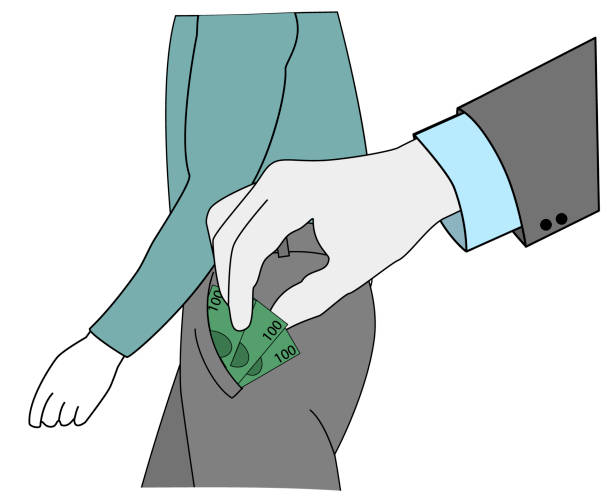

The NO on I-2124 campaign officially launched its campaign against the initiative that would make participation in WA Cares voluntary on Monday. Like WA Cares’ supporters who have gone before this coalition, the group fails to make a compelling argument that justifies taking money from low-income workers for a life need they might not end up having. In fact, many workers will be forced to hand their wages over to people with higher incomes and who are not in need of taxpayer help.

The campaign, made up of organizations that stand to benefit from the current taking of workers’ wages for WA Cares, also can offer workers no confidence that the inadequate lifetime benefit of $36,500 will be enough to cover a person’s long-term-care needs if they do have them and qualify for the money. They can’t. WA Cares’ benefit is not keeping up with the cost of long-term care.

Industry leader Genworth Financial found increases between 1% and 10% across various long-term care (LTC) facility types in its most recent Cost of Care Survey, continuing an upward trend seen the past several years. “The most substantial cost increases occurred in home health aide and homemaker services costs,” a March 12 press release said.

The company estimates that on the low end for LTC services, a part-time (20-hour-per-week) home health aide in Washington state this year will cost $42,848. A private room in a nursing home could run $169,178. Meanwhile, WA Cares’ website says its benefit of $36,500 “could cover around 20 hours per week of home care for about a year.”

A spokesperson for the group trying to defeat I-2124 was on The Lars Larson Show on Tuesday. On it, she misrepresented or isn’t aware of the actual cost of care and how inadequate the WA Cares benefit will be for handling most people’s needs. She also misrepresented how the benefit will increase, saying, as WA Cares’ proponents always do, that it will adjust with inflation. The law says the benefit is capped at the rate of inflation. That doesn’t mean it will rise with inflation. Count on nothing. (Read more here.) The program already has solvency concerns, further complicating what Washingtonians can count on.

Supporters of keeping the WA Cares program and its payroll tax mandatory, whether it will help workers paying for it or not someday, ignore or gloss over vestment criteria and other hurdles that will rule many workers out of an eventual benefit. They don’t deal with the trouble that the state gets to dictate your caregiver choices. They also seem unaware of how recently passed legislation allowing people to use the benefit if they move out of state works. As the WA Cares website explains, “To become an out-of-state participant, workers must have contributed to WA Cares for at least three years (in which they worked at least 500 hours per year) and must opt in within a year of leaving Washington.

“Like other workers, out-of-state participants will keep contributing to the fund during their working years. The state will create a process for out-of-state participants to report their earnings and pay premiums, with a focus on making it easy for participants.”

On Lars’ show Tuesday, the spokesperson from AARP erroneously said people would receive a percentage of the benefit for the years they paid the tax.

Unicorns and rainbows — everything will work out — continue to make up the messaging that WA Cares’ supporters are communicating, even when the shortcomings of this law have been exposed since its passage in 2019.

Lawmakers should repeal WA Cares at their first available opportunity. If voters pass Initiative 2124 in November, they can waste no time. Workers will opt out of what they know is a bad deal, leaving an entirely unworkable program.

There are better ways workers and government can prepare for the needs of our graying population — ways that emphasize personal responsibility and personal choice. It is time to focus on real solutions, such as individual savings, awareness and Medicaid reform.