Washington State’s Unconstitutional income tax on capital gains has two new challenges in the form of I-2109 and I-2111.

I-2109 is a straightforward repeal of the capital gains statute.

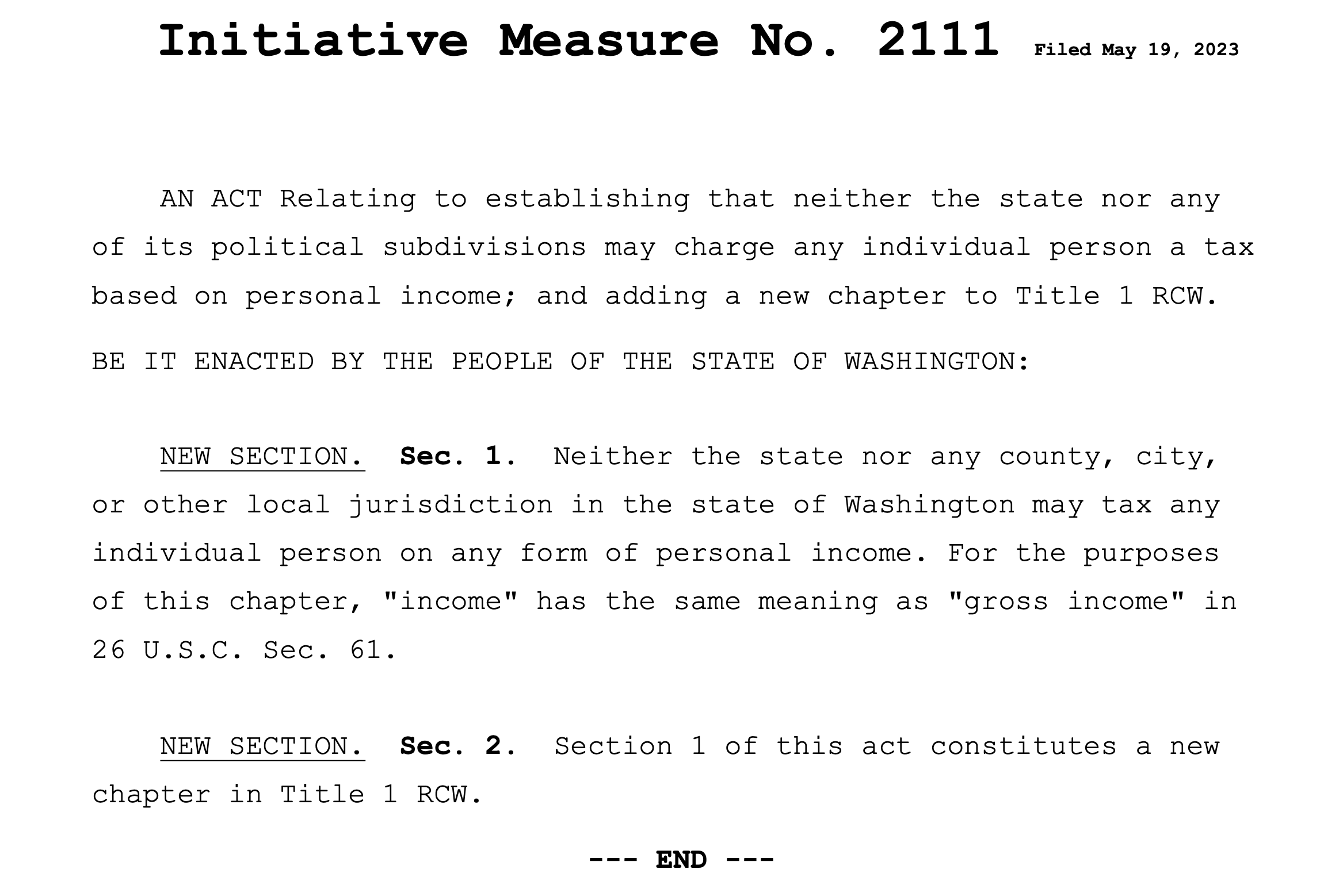

I-211 creates an RCW banning an income tax in the state. The statute would eliminate an income tax at any level in Washington State from the statehouse down to city hall.

Both measures are being run by Let’s Go Washington and are Initiatives to the Legislature.

There are differences between an Initiative to the People and an Initiative to the Legislature. An Initiative to the People is a direct vote on an issue. If it receives enough signatures it is placed directly on the ballot in the November general election.

An Initiative to the Legislature allows a proposal to be submitted to the legislature in the following session. The legislature may act on the proposal passing it into law without the vote of the people. If they do not act the proposal is placed on the ballot for a vote of the people at the next general election. The legislature may also propose their own measure and both will be offered at the next election.

You can find more information on all initiatives and referendums here.