Related Articles

Key Findings

- Proposition 14-5 would increase the local sales tax rate by 0.3 percent and collect approximately $9 million per year for increased public safety spending.

- Unless extended, the sales tax increase would end on December 31, 2024.

- Proposition 14-5 would increase the total sales tax paid by a family at the county’s median income by $87 per year.

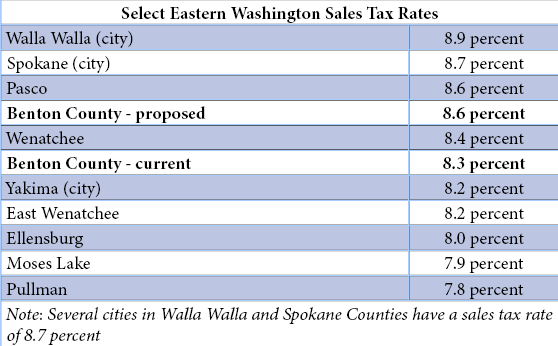

- If approved, the combined sales tax rate in Benton County would increase from 8.3 percent to 8.6 percent, tied for the third highest sales tax rate in Eastern Washington.

- Along with proposing the 0.3 percent sales tax increase, a Citizen Advisory Committee also recommended Benton County implement performance audits.

- Despite tying these recommendations together, no performance audits have been scheduled or are tied to the approval of Proposition 14-5.

- Although law enforcement staffing and the crime rate have held steady over the past decade, gang activity is on the rise and is commanding more of the existing resources and time available for other public safety needs.

Introduction

In August 2014, citizens in Benton County will vote on Proposition 14-5, a proposal to increase the local sales tax rate by 0.3 percent and collect approximately $9 million per year for increased public safety spending. Unless extended, the sales tax increase would end on December 31, 2024. The proposal would increase the total sales tax paid by a family at the county’s median income ($64,898) by $87 per year, or $7.25 per month.

The new revenue would be split between Benton County and the cities of Kennewick, Richland, West Richland and Prosser for law enforcement staffing increases and various public safety programs (such as gang prevention and intervention). If approved, the combined sales tax rate in Benton County would increase from 8.3 percent to 8.6 percent, tied for the third highest sales tax rate in Eastern Washington. The highest combined sales tax rate in the state is Mill Creek at 9.6 percent. Several cities in King and Snohomish Counties, such as Seattle, are at 9.5 percent.

Text of Proposition 14-5

The ballot description for Proposition 14-5 reads:

“The Benton County Board of Commissioners adopted Resolution No. 2014-25 that seeks to improve public safety including combating criminal gangs. This proposition would fund the hiring of additional police officers, corrections officers, and prosecutors; fund the Metro Drug Task Force and gang and crime prevention efforts; and fund court and clerk programs including a seventh Superior Court Judge and drug and mental health courts, by imposing a sales and use tax equal to three-tenths of one percent (three cents on a ten dollar purchase) with the tax expiring December 31, 2024.”

When voting unanimously to place this proposal on the August ballot, Benton County Commissioners cited (among other reasons) an increase in the complexity and sophistication of criminal activity, the presence of gangs, the fact that approximately 79 percent of the County’s general fund budget already goes to law enforcement and criminal justice programs and the recommendations of a citizen advisory committee as reasons for local law enforcement and officials supporting the sales tax increase.

How increased sales tax revenues would be spent

If approved, Proposition 14-5 would collect an estimated $9 million per year from citizens for public safety spending. Benton County would receive approximately 60 percent of these funds, and the rest would be distributed among the cities within the county based on population. According to the Benton County Law and Justice Council, if Proposition 14-5 is enacted, Kennewick would be able to hire 15 new police officers, Richland six and West Richland three, along with additional support staff.

Benton County would use the money to hire more staff across the criminal justice system, including a new Superior Court Judge, seven new sheriff officers and new prosecutors. Officials would also continue funding for the metro drug task force. There would also be an estimated $368,000 reserve fund “for consideration of additional criminal justice programs.” This level of reserve would equal approximately 4 percent of the $9 million officials would collect annually.

Past public safety sales tax increase efforts

Proposition 14-5 is not the first time Benton County voters have been asked to approve a public safety or criminal justice sales tax increase. In 1995, voters approved a 0.1 percent criminal justice sales tax which remains in effect today. According to the state Department of Revenue (DOR), Benton County officials collected nearly $3.6 million through that tax in 2013.

Benton County voters were also asked in 2007 and 2008 to approve a public safety sales tax increase of 0.2 percent. Those measures failed, with 58 percent of people voting “no” in 2008 and 53 percent voting “no” in 2007. By forwarding Proposition 14-5 to the ballot, County Commissioners are hoping that this sentiment has changed and that voters will now approve an even higher public safety sales tax increase of 0.3 percent.

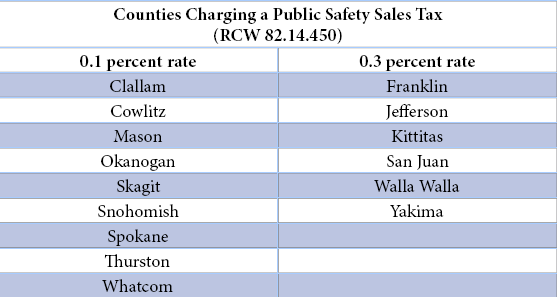

Difference between a criminal justice and public safety sales tax

Local governments have two different sales tax options to increase funding for public safety related spending. The first option is a criminal justice sales tax (authorized under RCW 82.14.340). Most counties in the state currently have enacted this tax increase of 0.1 percent, including Benton County. The second option is a public safety sales tax (authorized under RCW 82.14.450). According to the DOR, 15 counties in the state have enacted this tax, with nine using a rate increase of 0.1 percent and six using the maximum rate increase of 0.3 percent. Those counties are listed below.

Proposition 14-5 asks Benton County voters to approve a 0.3 percent public safety sales tax increase which, unless extended, would end on December 31, 2024.

Comparison of local sales tax rates

Proposition 14-5 would raise the combined sales tax rate in the county from 8.3 percent to 8.6 percent. This would be tied for the third highest sales tax rate in Eastern Washington. The highest combined sales tax rate in the state is Mill Creek at 9.6 percent. Several cities in King and Snohomish Counties, such as Seattle, are at 9.5 percent. The comparison of Benton County and other Eastern Washington jurisdictions is shown below.

The proposal would increase the total sales tax paid by a family at the county’s median income ($64,898) by $87 per year, or $7.25 per month. For a $50 purchase the current sales tax owed at 8.3 percent is $4.15. That same purchase under an 8.6 percent sales tax rate would owe $4.30 in sales tax.

Citizen Advisory Committee recommends tax increase

The Benton County Board of Commissioners established the Criminal Justice Sales Tax Citizen Advisory Committee to:

“. . . analyze and review all aspects of the criminal justice system in Benton County, develop an understand of their roles and resources, and make a recommendation to the Benton County Board of Commissioners as to whether or not a Criminal Justice Sales tax, as authorized by RCW 82.14.450 should be submitted to the voters of Benton County for approval and, if so, whether the Sales Tax should be in the amount of 1/10, 2/10 or 3/10 of one percent.”

The Citizen Advisory Committee met in 2012 and 2013 and issued its final report in June 2013. The Committee recommended that:

“. . . the Board of Commissioners place before the voters of Benton County a ballot measure for a criminal justice sales tax in the amount of 0.3 percent.”

Along with proposing a 0.3 percent sales tax increase the Committee said:

“. . . no revenue from this measure should be used to supplant existing revenue in the general budget used for criminal justice purposes. In addition, the committee recommends the Commissioners implement performance audits so the public can be assured their tax dollars are spent on programs and services which truly have the desired impact on crime and the factors which contribute to crime.”

According to David Sparks, county administrator for the Benton County Commissioners’ Office, there isn’t a plan to use the new revenue from Proposition 14-5 for “replacing or supplanting with the general fund, however, the adult and juvenile drug court would be replacing lost grant funding, as well as the drug task force unit.”

Among the findings of the Citizen Advisory Committee:

- The number of sheriff deputies per 1,000 residents has been steadily rising since 1985 when it was 1.1. Currently it is 1.7 which is as high as it has ever been.

- The violent crime rate was 3.31 per 1,000 in 1995 and 2.33 per 1,000 in 2011.

- In general, the crime rates in Benton County have been trending downward for a number of years.

- There has been a marked rise in gang-related criminal activity.

- There is a serious gang presence emerging in Benton County and with it comes intra-gang violence and crimes committed to support the gang lifestyle.

- Violent crime associated with gangs and drugs are increasing and investigating those crimes is costly.

- The law enforcement agencies cannot take proactive measures because existing resources are committed to reactive responses.

In an earlier draft report, the Citizen Advisory Committee recommended a 0.1 percent sales tax increase:

“The committee recommends the Board of Commissioners place before the voters of Benton County a ballot measure for a criminal justice sales tax in the amount of 0.1 percent.”

When asked for comment to explain why the Committee changed its draft recommendation from a 0.1 percent sales tax increase ($3 million a year) to 0.3 percent ($9 million a year) the Committee Chair Richard Nordgren, said:

“The committee agreed to operate with a ‘one voice’ policy, namely that no member of the committee would speak publicly unless the committee had agreed to release information. Early drafts and the final report of the committee was shared with the Law and Justice Council and then with the county commissioners as these bodies had called the committee into existence. Based on that policy I must decline your request for comments on early work products.”

One member of the Citizen Advisory Committee, Jerry Martin, however, told The Tri-City Herald

“Martin also said the citizens committee’s recommendation wasn’t based on data analysis and was unduly influenced by the county’s Law and Justice Council, which is comprised of criminal justice officials. Nordgren said the recommendation reflected the collective opinion of the advisory committee.”

As voters consider Proposition 14-5 it would be helpful for the Citizen Advisory Committee to provide more information concerning the decision to change its recommendation from the draft to final report given the large difference in the proposed sales tax increase and this charge for the Committee when it was created: “The intent is for the Citizen’s Advisory Committee to run fully independent of the Law and Justice Council and/or any of the governmental entities represented on that Council.”

Ultimately the Benton County Commissioners decided to put a 0.3 percent sales tax increase on the ballot though they had the power to propose a smaller tax increase.

No performance audits currently scheduled

The Citizen Advisory Committee also recommended the County pursue performance audits “so the public can be assured their tax dollars are spent on programs and services which truly have the desired impact on crime and the factors which contribute to crime.” Despite the Citizen Advisory Committee tying these recommendations together, no performance audits have been scheduled or are tied to the approval of Proposition 14-5.

According to David Sparks, County Administrator for the Benton County Commissioners’ Office, “The performance audit was a recommendation and the Commissioners have not made a decision on this topic. I think the Board will wait and see if the sales tax passes or not.”

Benton County Auditor Brenda Chilton confirmed that no performance audits are currently scheduled saying, “I am unaware of any performance audits being performed.”

Though not directly commenting on Proposition 14-5 or the recommendations of the Citizen Advisory Committee, Washington State Auditor Troy Kelley believes performance audits are a valuable tool for local governments. According to Kelley:

“Performance audits, when done right, can provide lessons of sound performance management to local governments across our state. They can help local leaders evaluate their programs and improve services using data-driven tools and techniques. Simply put, the rigorous evaluation provided by a sound performance audit can make government better.”

To help clearly communicate the County’s commitment to ensure dollars raised from the sales tax increase are efficiently and effectively spent to improve public safety, the County could agree prior to the election to pursue performance audits as proposed by the Citizen Advisory Committee. The County could earmark a small percentage of the estimated 4 percent reserve fund for performance audits if the tax is approved.

Conclusion

Although law enforcement staffing and the crime rate have held steady over the past decade, gang activity is on the rise and is commanding more of the existing resources and time available for other public safety needs. The approval of Proposition 14-5 would provide significant increases in spending on public safety programs. This has the potential to allow law enforcement to focus more proactively on crime fighting and to get ahead of the growing gang activity.

While the decision to include a 10-year sunset of the 0.3 percent sales tax increase is commendable, the failure of the County to implement the Citizen Advisory Committee’s additional recommendation for performance audits may be sending the wrong message to voters as they consider Proposition 14-5. Promising to use a small percentage of the estimated 4 percent reserve fund for performance audits would go a long way to communicating the County’s commitment to being strong stewards of any additional tax resources for public safety that the voters approve.

It is also concerning that no explanation was given by the Citizen Advisory Committee for radically jumping from a recommended 0.1 percent ($3 million a year) to 0.3 percent ($9 million a year) between its draft and final report. Additional details would help provide voters more context on why the independent Citizen Advisory Committee made this decision. Ultimately the final authority to propose a 0.3 percent or smaller sales tax increase was the responsibility of the Benton County Commissioners.

Providing for public safety is the government’s highest priority. In weighing Proposition 14-5, voters will need to determine whether the case has been made for moving from an 8.3 percent sales tax rate to 8.6 percent, among the highest in Eastern Washington, and the impact this increase would have on future efforts to raise taxes in the cities, county and area public facility districts. Voters will also have to consider whether enough accountability (like performance audits) has been built into the proposal to evaluate the impact the tax increase would have on actually improving public safety, as supporters promise.