Related Articles

Relevant Topics

The commission that meets to learn how WA Cares’ tax collection, future solvency projections and program details are going is meeting again on Dec. 12. The agenda is out, available here, and it includes recommendations the group has discussed before and plans to give to the Legislature for consideration in its 2024 session.

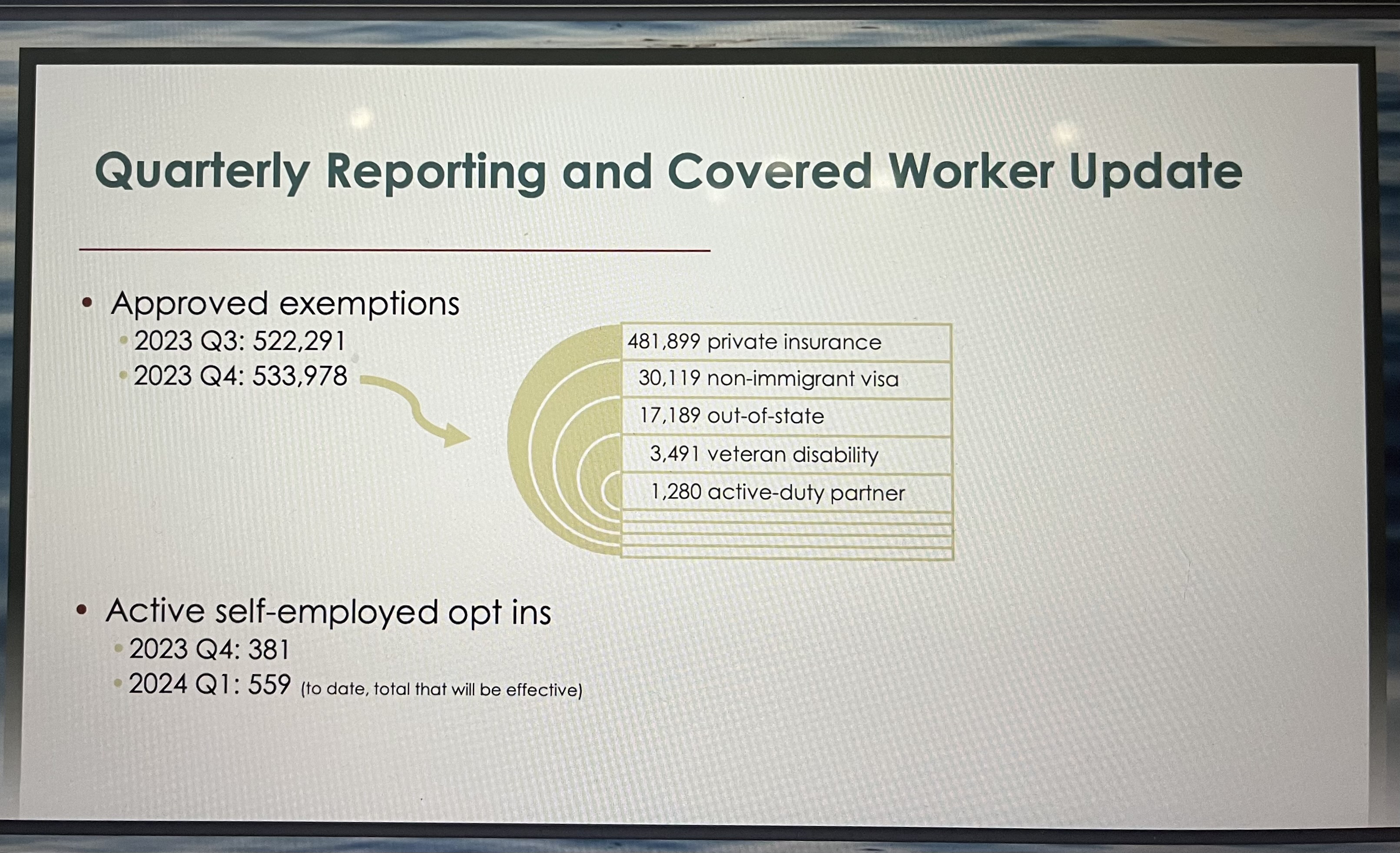

A presentation within the agenda also includes the number of workers who sought exemptions from the new payroll tax, as well as the number of self-employed workers who say they want into the long-term-care (LTC) program that is mandatory for the state’s W2 employees.

Let’s start there: The total number of people whose exemptions from WA Cares have been approved is 533,978. They could have gained approval because they already had private long-term-care insurance or were exemption applicants who are in the state on a non-immigrant work visa, live out of state, or are disabled vets or the spouses of active-duty service members. On the other hand, the number of self-employed workers wanting to have 58 cents of every $100 they earn taken from their paychecks to hopefully obtain up to $36,500 from taxpayers someday for long-term care is 381 for a similar timeframe. (That number, the state reports, will rise in the first quarter of 2024 to 559.)

I’ll highlight a few of the key recommendations that, if adopted by lawmakers, would change the WA-Cares face that has been presented to those paying the tax up until now. They are reminders that lawmakers can modify this long-term care social program at any time, much like the tax rate for Paid Family and Medical Leave doubled in its short lifetime.

- To create limited portability of a WA Cares benefit, meaning that after workers pay into WA Cares during their working years they could move to Florida and still receive the benefit, a workgroup on the commission wants to increase the number of hours worked required for all who are taxed for WA Cares. A qualifying year would go from 500 to 1,000. (That’s notable to me especially because workers will need to have 10 qualifying years without a break of five or more years.)

- The portability workgroup also recommends a ballot measure to allow the state to invest funds in new ways. That's something voters already said “no” to before.

- Also suggested is that lawmakers “incorporate into functional assessment a 90-day forward certification of need” for workers utilizing the benefit. Those are among 10 recommendations from the portability workgroup.

- A good recommendation being pursued by another workgroup is to “modify the exemption process for temporary non-immigrant visa holders working in Washington state. Exempt wages earned by non-immigrant visa holders from premium collection, with the ability to voluntarily participate if they so choose.” This is how it should have been from the start for all the groups of people currently eligible for WA Cares’ exemptions. I think making them voluntarily apply for an exemption was a strategy to keep wages from people who will never be eligible to benefit from WA Cares. The recommendation is being made because of the amount of work involved in handling exemptions from this group, which includes agricultural workers.

To see more recommendations proposed, visit the agenda’s presentation of slides here. To attend the meeting online, which includes time for public comment, view the upcoming meeting information and agenda available in an “upcoming meetings” section of the WA Cares website here.

There's more to come

Materials for the meeting indicate that a minimum provider qualification to be paid for services with WA Cares Fund tax dollars, as well as the establishment of payment maximums for approved services, will be addressed by the commission in 2024.

Managing this safety net built for people who might not need to rely on taxpayers has become a lot of work. Prohibiting easy access to Medicaid dollars meant for vulnerable people is where the state should have been, and should be, focusing. Read more about how relieving Medicaid of its dominant LTC financing role would result in more personal responsibility planning for long-term care and a better equipped LTC workforce and higher quality LTC here. The op-ed in The Washington Times starts this way: “To solve the nation’s looming long-term care financing crisis, policymakers must deal with one key fact. Most people do not consume their life savings paying for this care.”

Our state has gotten it wrong trying to deal with its long-term-care costs and should repeal WA Cares. The government should be helping taxpayers afford more of their life needs, not dictating which life need they have to save for — in the state’s piggy bank and for which they might never be eligible.