Related Articles

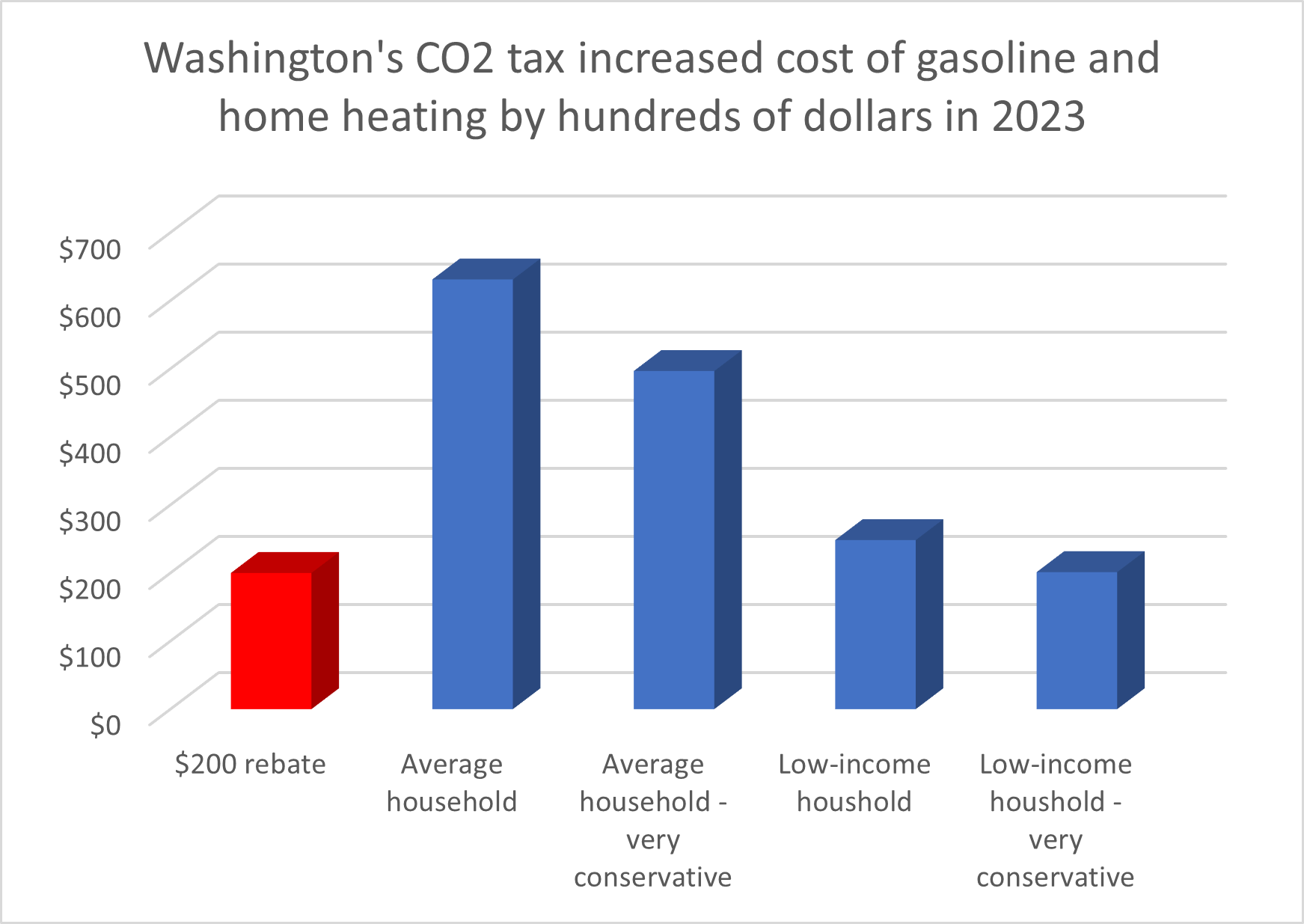

The average Washington household with two cars paid about $631 more for gasoline and natural gas heating in 2023 due to the state’s new tax on CO2 emissions known as the “Climate Commitment Act.” That amount does not include increased costs for electricity, which vary widely based on geography, or the inflationary impact of higher energy costs on other goods.

Those amounts put some context on the payment of election-year rebates touted this week by Governor Inslee, staff at his state agencies, and others who want to keep the state’s tax on CO2 emissions.

Governor Inslee and staff from the Department of Commerce and Seattle City Light announced a one-time payment of $200 to a limited number of utility customers in Washington, paid for by the tax on CO2 emissions.

In a press release, Governor Inslee said, “We are committed to ensuring that the benefits of the state’s clean energy transition reach everyone, especially those most burdened by energy costs.” That commitment didn’t exist until this year. The $200 payment was not part of the original package adopted in 2021 and was only added by the legislature this year.

The $200 doesn’t come close to covering the increased costs of the CCA for average or even low-income households with one car.

According to the U.S. Department of Transportation, the average vehicle in Washington state drives 10,424 miles per year. In its 2023 Automotive Trends report, EPA notes that “real-world fuel economy” for light-duty vehicles increased to 26 miles per gallon. For a two-car home, that amounts to about 800 gallons per year. Based on Washington’s average CO2 tax in 2023 of $55.90 per metric ton of CO2, that added $448 in costs.

This assumes that all of the cost of the CO2 tax is passed along in higher gas prices. That hasn’t always been the case. For example, Oregon’s gas price was virtually identical to Washington’s in December of 2022, but today it is about 31.6 cents per gallon lower than Washington’s. Not all of that is associated with Washington’s CO2 tax, which at current prices adds about 23.7 cents per gallon. A month ago the difference was 25.9 cents per gallon, which is still slightly higher than the CO2 tax would indicate. During 2023, there were times when the gap was smaller than the CO2 tax would imply. For example, at the end of July, when the CO2 tax would imply a tax of 44 cents per gallon, the gap between Washington and Oregon was 34 cents per gallon – about 23 percent lower.

This assumes that all of the cost of the CO2 tax is passed along in higher gas prices. That hasn’t always been the case. For example, Oregon’s gas price was virtually identical to Washington’s in December of 2022, but today it is about 31.6 cents per gallon lower than Washington’s. Not all of that is associated with Washington’s CO2 tax, which at current prices adds about 23.7 cents per gallon. A month ago the difference was 25.9 cents per gallon, which is still slightly higher than the CO2 tax would indicate. During 2023, there were times when the gap was smaller than the CO2 tax would imply. For example, at the end of July, when the CO2 tax would imply a tax of 44 cents per gallon, the gap between Washington and Oregon was 34 cents per gallon – about 23 percent lower.

To be safe, if we assume that gas stations eat about 30 percent of the cost – passing along 31 cents per gallon instead of the actual 44 cents implied by the tax – the additional cost for a two-car family from the CO2 would be about $314 for 2023.

For natural gas, the U.S. Energy Information Administration reports that the average home in Washington uses about 617 therms annually. At $55.90/MT CO2, that adds about $183 per year.

Using those estimates, the average, two-car family, paid an additional $497 to $631 in 2023 alone due to the CO2 tax.

The rebate, however, only covers about 20 percent of Washington households according to the Department of Commerce, targeting those with lower incomes. Even for those households, the rebate is unlikely to cover the increased cost of the tax.

A one-car family driving the average number of miles would have paid between $156 and $224 more in gasoline costs in 2023. If a low-income family used only 60 percent of the average amount of natural gas for home heating, that added another $110 to their costs. So, a one-car family using much less natural gas than average still saw an increase in energy costs between $266 and $334 in 2023. The one-time rebate would only cover about two-thirds of their increased costs.

The only way the CO2 tax would add less than $200 to a family budget is if they used half the average amount of natural gas and drove one car only 20 miles per day – about 30 percent less than average. Even then, the family would only break even for 2023 and the rebate would cover none of the costs in 2024 or the future.

Those calculations don’t include increased electricity costs, which are increasing for a variety of reasons, including the CO2 tax.

Seattle City Light’s Chief Customer Officer Craig Smith was quoted in Commerce’s press release saying, “City Light is committed to connecting our customers to valuable resources to help reduce their electric bills.” That claim is undermined by the fact the City Light has consistently raised its rates over the past few years, adding about $108 a year to the typical customer in 2025.

Nor do they include the inflation of goods caused by increased energy costs for transportation and other inputs.

However, even if we only focus on direct costs for gasoline and home heating, the $200 checks being offered in an election-year effort to reduce the impact on low-income families is likely to be well below the costs paid in 2023 alone.