Food producers and food transporters who bought fuel in 2023 and were taxed for it under the Climate Commitment Act can now apply for a refund. The Washington State Department of Licensing has launched a website that went live Monday.

At the conclusion of the most recent legislative session, the state set aside $30 million to fund rebates for farmers and food transporters who were subjected to an illegal tax via the Climate Commitment Act (CCA). Under the CCA, food producers, among other groups, were provided an exemption from the fuel tax. The law directed the Washington State Department of Ecology to create a pathway for that exemption to occur. However, Ecology never followed through on that directive, leaving farmers and others, stuck paying the tax.

Section 10 (e)(i) and (ii) of the CCA read:

“Motor vehicle fuel or special fuel that is used exclusively for agricultural purposes by a farm fuel user. This exemption is available only if a buyer of motor vehicle fuel or special fuel provides the seller with an exemption certificate in a form and manner prescribed by the department. For the purposes of this subsection, ‘agricultural purposes’ and ‘farm fuel user’ have the same meanings as provided in RCW 82.08.865.

The department must determine a method for expanding the exemption provided under (e)(i) of this subsection to include fuels used for the purpose of transporting agricultural products on public highways. The department must maintain this expanded exemption for a period of five years, in order to provide the agricultural sector with a feasible transition period.”

A rebate of the taxes paid is better than receiving nothing. However, it is difficult to quantify how much fuel was purchased by our state’s farms and ranches in 2023. Some producers make bulk purchases of fuel, delivered to their farms and ranches by tanker trucks from fuel distributors, while others take small tanks to local gas stations and fill them with repeated purchases at the pump. Some fuel distributors participated in a voluntary tracking of the exemption cobbled together without the help of Ecology while others did not. Gas stations had no mechanism to provide a rebate or observe the exemption for “at-pump” purchasers.

The U.S. Census of Agriculture 2022 data notes 30,230 farms reported fuel purchases totaling $443 million between 2017 and 2022, or an average of $88.6 million in fuel expenses annually, before the implementation of the CCA. If that is used as the benchmark for agricultural fuel purchases, the state is well short of having budgeted enough to cover the costs incurred by farms and ranches in 2023. The total budgeted $30 million rebate fund probably will not cover the needs of the agricultural community, even with the $4,500 rebate cap that has been imposed. If every gallon of fuel received a rebate at 45 cents a gallon, the total cost for 2022 purchases would be $39.8 million, short-changing our farming community nearly $10 million before food transporters received a refund. In fact, if all 30,230 farms that reported fuel purchases on the census claimed the full $4,500 maximum rebate, the total cost would be $135 million, more than $100 million short but closer to anecdotal estimates by agricultural industry members.

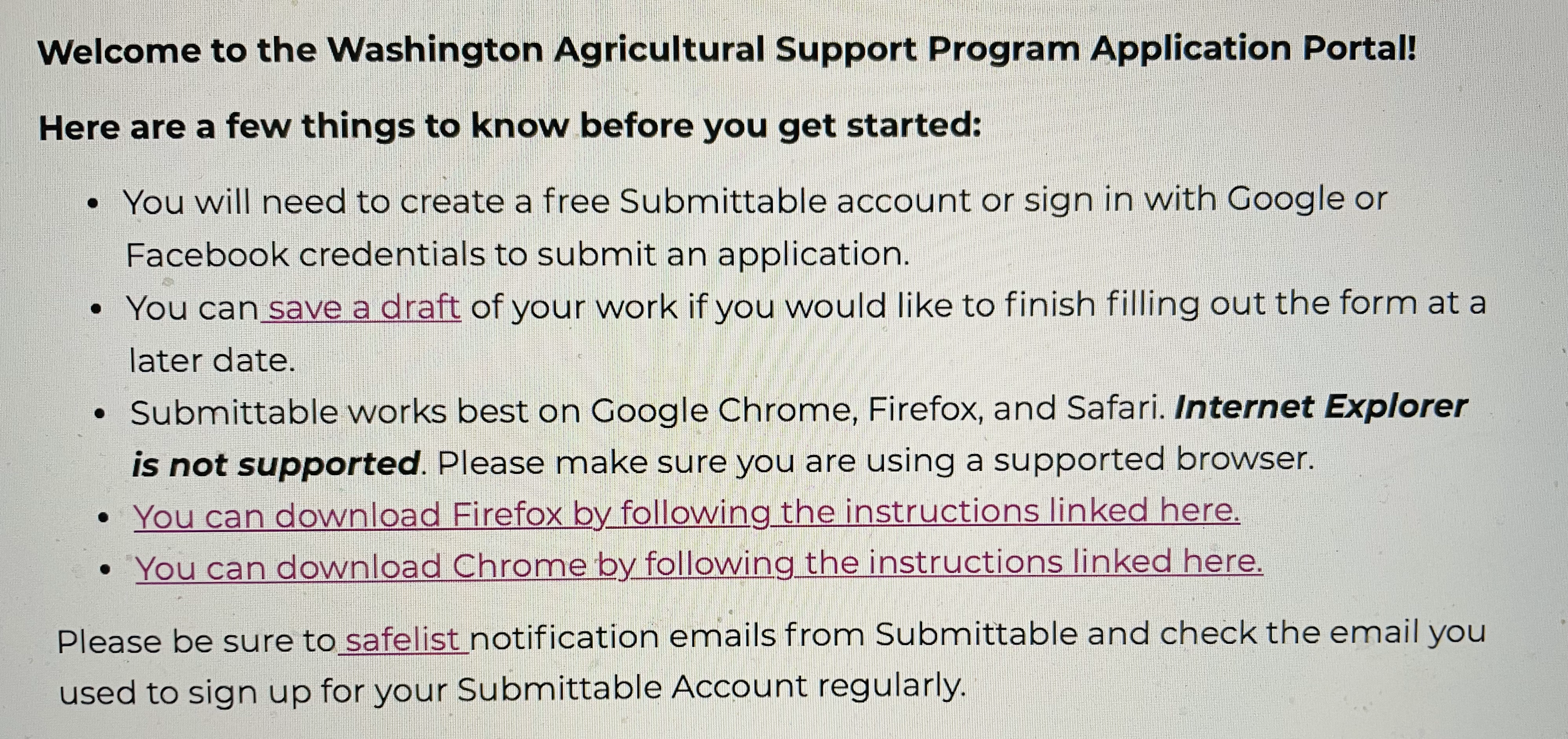

Along with the challenges in the rebate budget, are the flaws on the website itself. Washington state is home to Microsoft and Google, yet our state agencies cannot build a website that will function on an Internet Explorer browser. Farmers, ranchers, and food transporters who wish to apply for a rebate will need to use one of the three “best” browsers according to Washington state: Google Chrome, Firefox, or Safari. Once one of the supported browsers is in use, however, if applicants have a Facebook account, they’re all set to login. Applicants can also use an email address or a Google account.

The website is clunky, asking for everything from a digital copy of an applicant’s photo ID or taking users through a series of questions to confirm their identity, collecting the unified business identifier (UBI) number of the applicant, and more, without any warning. A “things you need” list on the DOL landing page would make the site more user friendly and make the application process quicker and easier.

Potential for the budgeted funds to run dry, awkward lack of easy browser access, and lack of an easy user prep list should not be deterrents for food producers and transporters who bought fuel in 2023. Washington state carved out an exemption for food production and transportation that was never implemented. Assessing an additional burden on our food producers and transporters through the fuel tax was not supposed to occur under the CCA. It has taken nearly two full years since the implementation of the cap-and-trade program for the state to come up with a rebate system for the people harmed by agency negligence. Time for food producers and transporters to reclaim at least some of what they are owed.