Related Articles

A bill to impose a Road Usage Charge (or RUC), also known as a vehicle mileage tax, has been introduced in the State House of Representatives. As proposed, the tax would be phased in with voluntary enrollment of electric and hybrid vehicles in 2027 followed by mandatory enrollment of vehicles with internal combustion engines. By 2035 all vehicles with a fuel economy rating of more than twenty miles per gallon would be subject to the tax. This mileage tax would replace the existing gas tax and annual registration fee for electric vehicles. The proposed rate, 2.6 cents per mile, approximates the average annual amount paid in gas tax.

The bill cites the need to improve the condition of state highways, which WSDOT estimates will cost an additional billion dollars per year to restore to a “state of good repair”. To that end, the bill would dedicate revenue from the 2.6 cents per mile tax to “preservation and maintenance highway purposes”. However, the bill will not address the massive backlog of needed highway work because in the near term replacing the gas tax with an equivalent mileage tax doesn’t increase the revenue available for highway maintenance, it only gradually swaps one revenue source for another.

Eventually the mileage tax would avoid the longer-term erosion that is beginning to occur with the gas tax, but it wouldn’t produce a meaningful revenue increase until after 2031 or later. As a result, our state highways and bridges, which have already been allowed to deteriorate to a dangerous extent, will continue deteriorating unless the legislature finds some other source of revenue. The primary purpose given as justification for the tax will not be achieved, at least not anytime soon.

The problems of the proposal don’t end there. In addition to the 2.6 cent per mile tax, the bill also adds a 10% “assessment” the proceeds from which would be used for “Rail, bicycle, pedestrian, and public transportation”. So, while the state’s highway system would continue to be inadequately funded the revenue from this assessment would be directed to non-highway purposes.

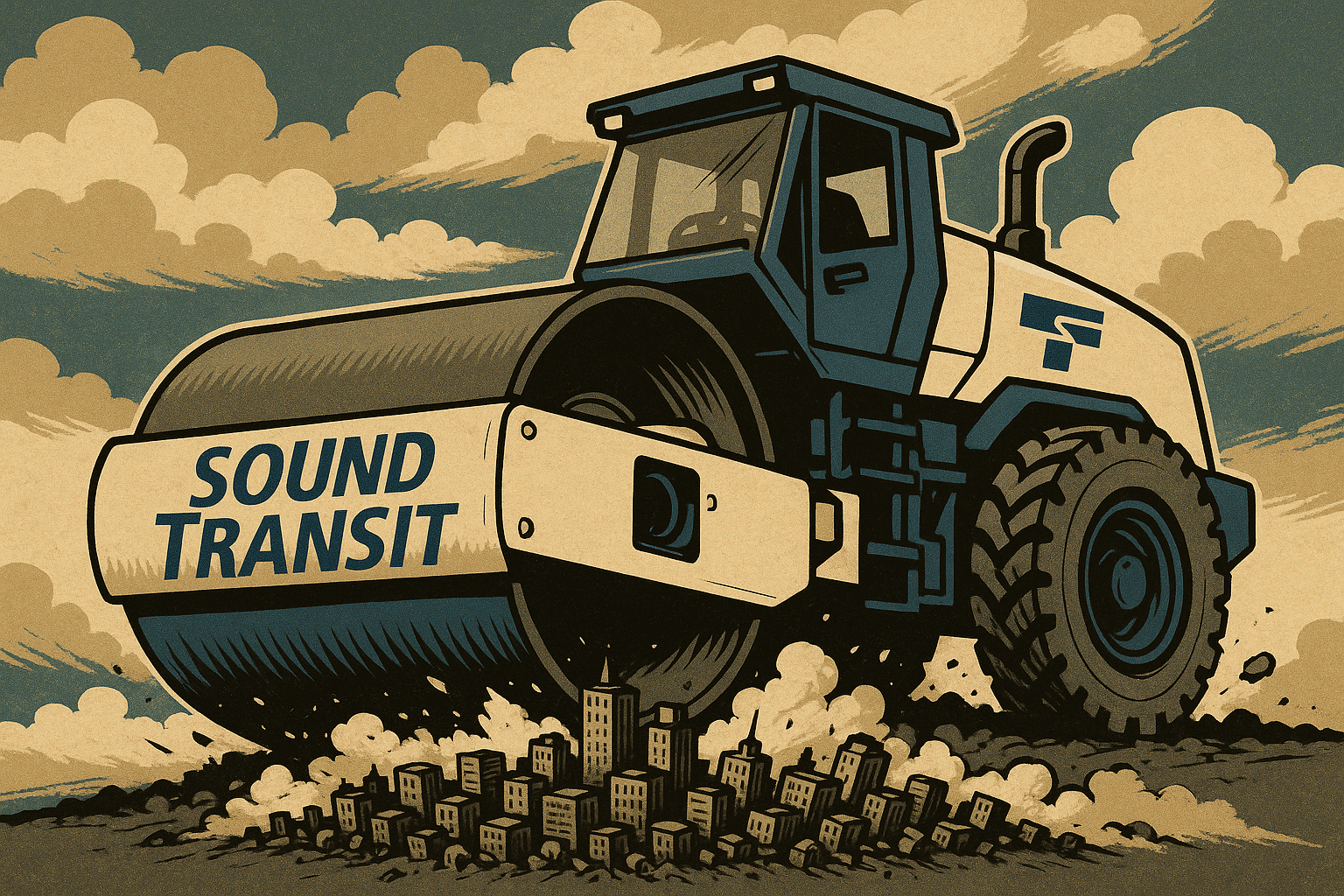

If the transit agencies were truly in need of additional funding there might be an argument for that, but in 2023 total transit revenue in Washington was in excess of $5.7 billion, which is about ten times as much as WSDOT spent on highway preservation and maintenance. And while WSDOT depends on the legislature to provide its funding, the transit agencies have their own dedicated revenue sources including sales taxes, farebox revenue, Federal grants, and in the case Sound Transit, property tax. Of the thirty transit agencies in Washington only a very few assess the full sales tax they are authorized. Either they don’t believe they need additional revenue or they’d rather get a cut of a mileage tax from motorists than ask their own constituents to approve a sales tax increase or increase fares.

The problem of state transportation revenue being redirected to other purposes is not new. More than eighty years ago the voters of Washington approved the 18th amendment to the state constitution to ensure that revenue from the gas tax and vehicle license fees is used exclusively for highway purposes. Had that constitutional provision not been enacted our state’s highways might be in even worse condition today. The legislature seems to have other priorities. By describing the additional 10% charge as an “assessment” rather than a tax or license fee the legislature is attempting to circumvent the 18th amendment’s protection. The legality of the legislature’s semantic slight-of-hand could well be challenged in court, but what is undisputably true is that the bill’s intent is to divert revenue from highway users to other purposes.

The House Transportation Committee will hold a public hearing on the bill (HB 1921) Thursday, February 13th, at 4:00. Those interested in testifying are encouraged to register at https://app.leg.wa.gov/csi/house?selectedCommittee=31651&selectedMeeting=32709

At the website citizens can also register their support or opposition without testifying.