The button works — for some people! Baby steps.

If you have private long-term-care insurance (LTCI) and want to opt out of a new long-term-care payroll tax starting in January, you can apply for an exemption with the state of Washington starting today. Maybe. For those who got in before the site crashed, minutes after it opened, I hear it was easy. I have not had success.

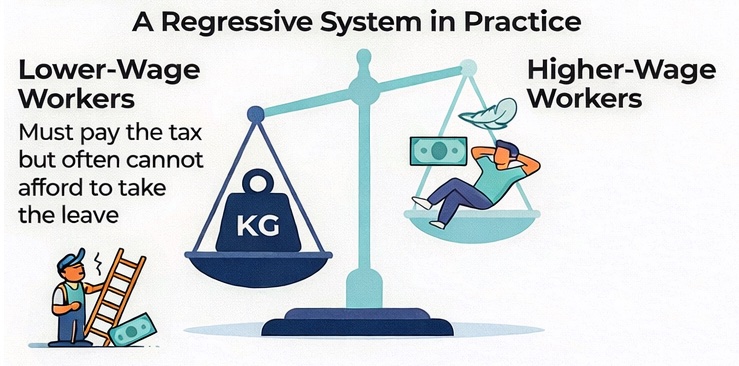

Read more about the regressive tax and misguided law that created it here.

This law concerning long-term care should be repealed by lawmakers. The new mandate burdens family budgets, makes false promises and takes away choices. For now, those who have private LTCI can apply to opt out of the state program and payroll tax by following the steps below.

Go to an "apply for an exemption" button near the bottom of the “exemptions” page of the WA Cares Fund website. Click it and follow the directions on the next page you're linked to (be prepared to set up a Secure Access Washington (SAW) account and upload proof of identity).

When you get to the actual exemption request, you'll need to click five boxes, including verification of age, that you have a private plan and that you are giving up access to the state's taxpayer-funded plan. Then submit.

Wait for state officials to approve your application, which isn't the day you apply. The state might get back to you for more information.

If your application is approved (watch for that in your SAW account information), there’s one more step: At some point, you’ll need to access a letter available through your SAW account and show it to your employer, so you won't be paying this payroll tax. You’ll need to show the letter to all future employers.

The window for application will stay open until December 2022. Remember, however: You need to have a private, qualifying plan before Nov. 1 of 2021 to even be considered for exemption. And unless you already have one in process, we've heard none are available until after that cut-off date.

I'm far more interested in policy than process, but people have been looking for process help with this task and finding little more than a public-relations campaign from the state. So here's some help. For specific questions, try contacting wacaresfund@dshs.wa.gov.

Update: This is the message some of us were getting in the 11 a.m. hour on Oct. 1.

Update: Most people I know, including me, were able to get through and apply on Saturday, Oct. 2 — after many tries and site shutdowns. I edited my bulleted instructions after seeing the process with my own eyes.