It was 1980, and my grandpa, an agricultural economist with the U.S. Department of Agriculture, had just retired from the Washington D.C. office. One week later, on January 4, 1980, President Jimmy Carter placed a grain embargo on the Soviet Union because of the Soviet army’s invasion of Afghanistan.

Joking aside about my grandpa’s perfect timing in dodging an international crisis, the lesson I learned was that in trade wars all sides lose.

Our family story goes something like this: “Grandpa visited his former co-workers’ office shortly after the embargo was announced. Everyone was running around in a panic, and it was already estimated that for American farmers it would have been cheaper to fill a battle ship with wheat and sink it in the Atlantic than to implement the embargo.”

The government suddenly had to find a home for $2.6 billion worth of grain. Farmers suffered from price decreases and market share was lost as the Soviets found other trading partners and developed their domestic markets. Ultimately, the grain embargo did nothing to prompt the Soviets to pull out of Afghanistan, which they did for their own reasons nine years later.

In 2018, the president announced steel and aluminum tariffs against China and other countries and has mentioned plans for more tariffs on $60 billion of Chinese goods. Why? Because the administration believes protectionism will stop intellectual property theft better than pursuing enforcement under the existing and legal framework of the World Trade Organization.

With our historical experiences, why would we think the US is better off to embark on another trade war?

The short answer is...we are not better off.

China officials have already said, “We will certainly take countermeasures of the same proportion and of the same scale, same intensity.” On Monday, April 2nd the Chinese government announced tariffs on 128 products including fresh fruit, dried fruit, nuts, wine, and pork.

Unfortunately, for those in agriculture it comes as no surprise that farm products made the list. Agriculture Secretary Sonny Perdue said, “As is the case with China, agricultural products are often among the first to be targeted in retaliation. The administration stands ready to defend agricultural producers who may be harmed. As we take a stronger approach to the way we handle trade as a nation, we will use all of our authorities to ensure that we protect and preserve our agricultural interests."

But this “stronger approach” hurts farmers at a time when farm incomes are low and it is likely to make American farmers even more dependent on federal farm subsidies. Farmers will also lose recently-developed Chinese markets to other competitors.

Washington state, as one of the most trade dependent states in the nation, will only be worse off.

Washington is the third largest exporter of food and agricultural products in the nation and one of our top exports is fresh fruit, a commodity targeted by the Chinese tariffs. In 2017, Washington shipped $18.2 million worth of product to China, accounting for 23.7% of Washington's exports. Washington ranked the highest in total value of exports to China and only two other states have a higher proportion of their exports bound for China (New Mexico and Alaska).

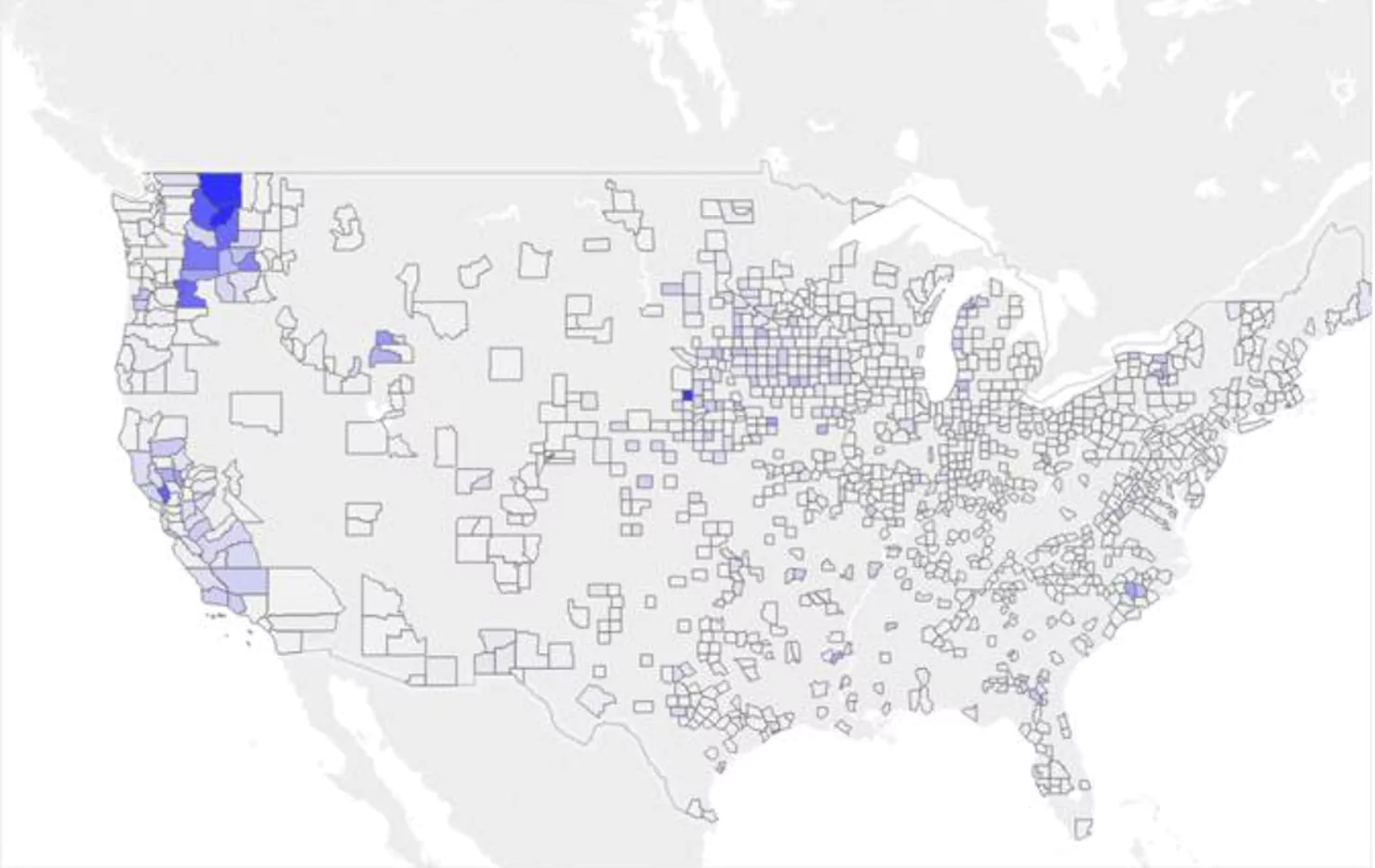

A recent study by the Brookings Institute shows Eastern Washington will be one of the most affected regions in the country due to the Chinese tariffs. The study examined the concentration of jobs involved in the industries targeted by the tariffs.

Not only will farmers and the agricultural workers be hurt by the tariffs, so will all Washington’s taxpayers. Washington state citizens can view the beginnings of this trade war as a future tax increase. Washington state’s revenue forecast in February was higher than expected, justifying an immediate property tax cut by the 2018 legislature. However, the revenue forecast stated, "Risks to the baseline include stock market volatility and concerns about international trade and fiscal policy.”

If tax revenue decreases due to a trade war, taxes will be increased to make up the difference.

Instead of starting an illegal trade war, perhaps the administration should consider the merits of enforcing World Trade Organization regulations. There are provisions under the WTO that would allow U.S. companies to protect their intellectual property without undermining global trade by entering this damaging trade war. That would benefit the U.S. economy as a whole and leave Washington state better off.