The Washington State Economic and Revenue Forecast Council met yesterday to present the Q2 2023 economic and revenue forecast. You can find the recording of the meeting here and the meeting documents here.

The updated forecast from Q1 shows an increase in revenue of $815 million over the current biennium (ending June 30th) and the 2023-2025 and 2025-2027 biennium. The state is required by law to adopt a four-year balanced budget and the revenue forecasts are instrumental in shaping budgets for lawmakers.

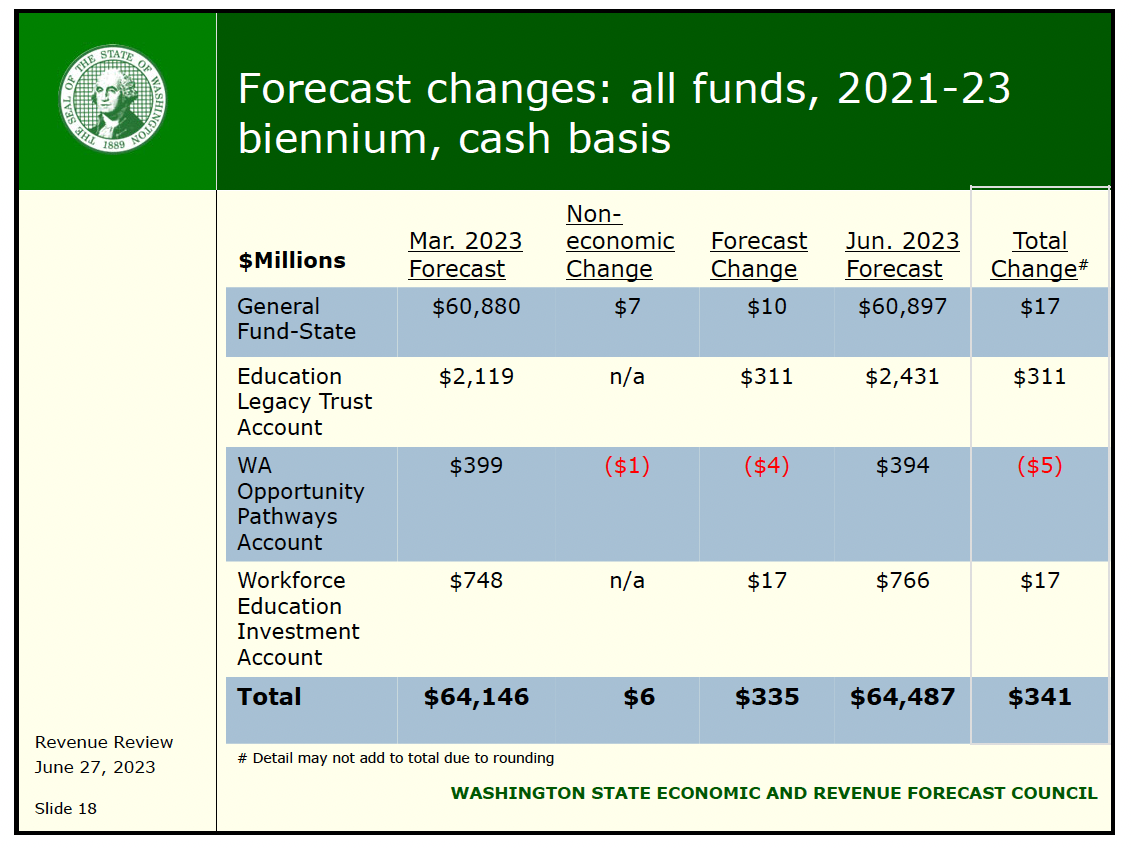

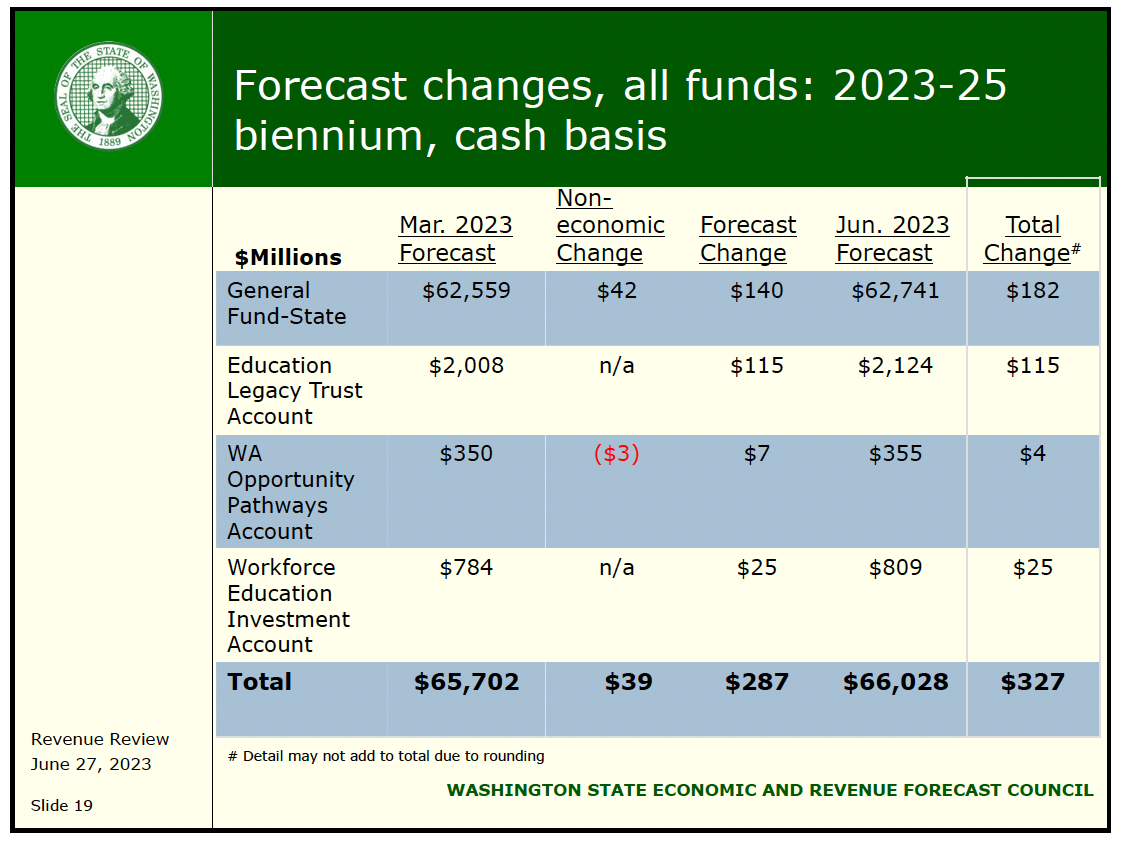

The increase from the Q1 revenue forecast was $341 million for 2021-23, $327 million for 2023-25, and $147 million for 2025-27.

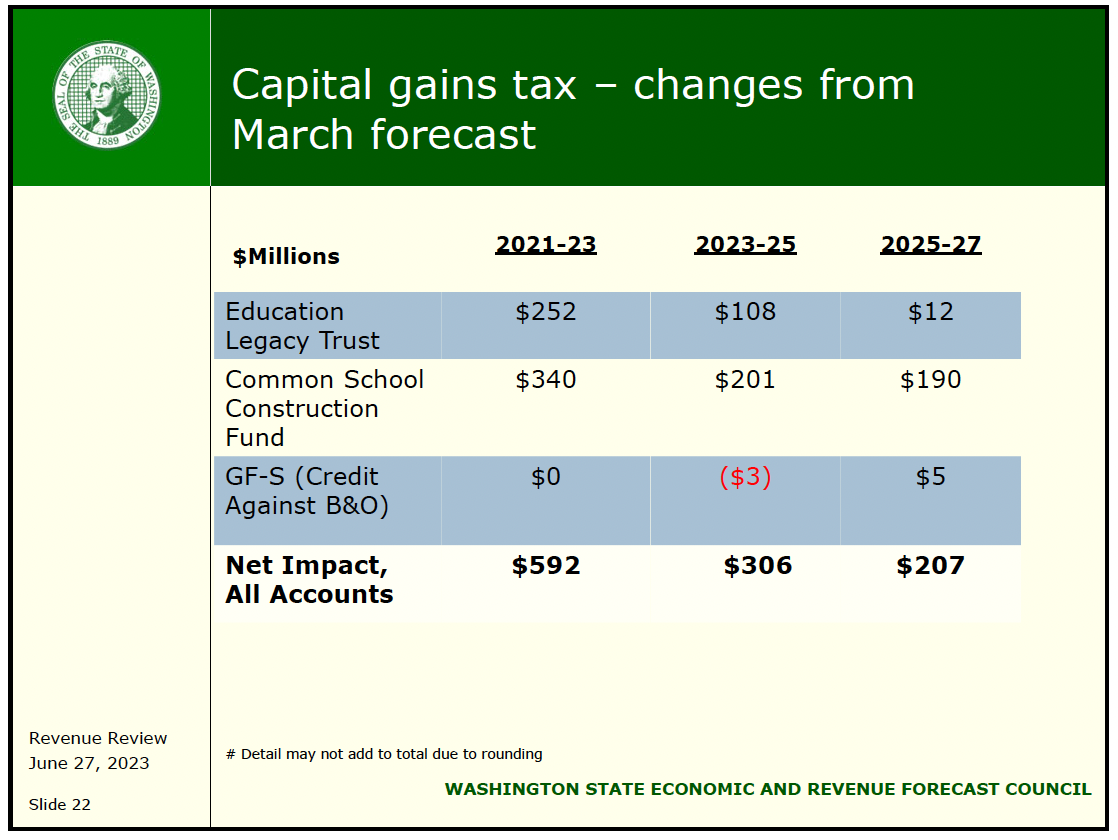

Capital Gains Collections Drives Growth

Unsurprisingly the biggest driver of change was the higher-than-anticipated collection of income tax on capital gains. As noted by the ERFC report “Revised capital gains forecast reflects higher than expected collections.”

The report and commentary did signal caution amid “quite a bit of uncertainty around those collections”. 60% of the returns so far have been estimated. They note that when returns are finalized by Oct, they may see some refunds. Additionally, capital gains taxes are historically very volatile and can be tough to predict.

Other items of note in the Q2 forecast.

The report notes that tax collections have slowed, and inflation remains high even though it is slowing. There is concern about slower growth leading to recession. Employment growth is trending down over the past two years. Real estate excise taxes have slowed dramatically compared with 2022.

The next revenue forecast for the state will be on September 26th.