It is not a surprise to see the state budget grow during a session that taxpayers and the economy were already providing healthy revenue growth. What is a surprise, however, is watching lawmakers adopt a massive $8 billion budget increase far in excess of that revenue growth while imposing substantial tax increases. This is even more troubling considering warnings that the good times will not last and fiscal discipline was necessary to avoid repeating the problems experienced with the massive 2005-09 budget expansions followed by the great recession.

Along with sustainability concerns with the 2019-21 budget, there was a total breakdown of the public process in the final days of session when adopting the tax and spending package. We’ll have more to say on the need for legislative transparency reforms in the near future.

As for the dollars-and-cents of the 2019-21 budget, it is important to remember that the substantial revenue growth already being provided by taxpayers was sufficient to meet the 2019-21 maintenance level budget estimated by the 2017-19 four-year outlook. This means the $1 billion in tax increases imposed were in-part for more than $2 billion in new policy additions. Those new policy additions include in-part:

- Compensation increases (wages/benefits): $970 million

- “Off-budget” Higher education (HB 2158): $373 million

- K-12 education changes: $279 million

To help pay for these new policy additions approximately $1 billion in tax increases were imposed:

- HB 2158 (“off-budget”) – B&O increase on select professional services: $380 million

- SB 5998 – Graduated Real Estate Excise tax: $245 million

- HB 2167 – B&O increase on banks: $133 million

- SB 5581 – Sales tax nexus change related to Wayfair ruling: $116 million

- SB 6016 – B&O changes for international investment management companies: $59 million

- SB 5997 – Changes to non-resident sales tax exemption: $54 million

- HB 1873 – Vaping tax: $27 million

- SB 6004 – B&O tax increase for travel agents: $5 million

We’ll have more to say about the horrendous process used to enact HB 2167 soon, but this tax increase was the epitome of why every Washingtonian should fear the legislature’s constitution-circumventing abuse of Title Only bills.

There were also two other tax increases of note. The legislature also raised the state’s oil barrel tax (SB 5993) by $173 million and imposed a payroll tax for long-term care (HB 1087) with an estimated tax increase on wage earners of $1.3 billion in 2021-23.

Though seemingly insignificant, the changes to the non-resident sales tax exemption (SB 5997) could have a huge impact on border communities like Vancouver and the Tri-Cities. As reported by the Columbian:

““It’s going to be devastating for many or the majority of businesses here locally in Southwest Washington,’ said Debbie Runyan-Parker, owner and president of Runyan’s Jewelers, 327 N.E. Fourth Ave., in Camas.

‘We’re just coming out of the recession and now they’re hitting us with this. It will definitely make a mark on how much business we do,’ said Runyan-Parker, who estimated 20 percent of her store’s sales are to Oregon residents.

Ed Fischer, owner of Camas Bike and Sport, said he also anticipates a loss of Oregon customers.

‘This could be the straw that breaks the camel’s back in my retail business here,’ said Fischer, who said the exemption was sometimes a motivation for an Oregon resident to choose to come to his shop rather than the 60 bike shops in the Portland area.”

Brushing aside these concerns, Rep. Stonier, the House Majority Floor Leader, told the Columbian:

“‘There was little to no public testimony about the bill,’ Stonier said, adding, ‘The bill moved pretty quietly through the system.’”

According to the bill report, here is the testimony against this tax increase:

"The bill has a negative impact on Washington cities and the state as a whole. Cities along the Oregon border report that over half of their customers are from outside the state. This tax preference was reviewed and determined it was meeting its public policy objective and thus was recommended it continue. Very few people will use the remittance program. Another good example of using a tax study to inform the policy. We do not know how this legislation will impact the practices of people coming in state to shop."

During the tax preference performance review for this tax incentive the Legislative Auditor recommended:

“Continue because the preference is meeting its inferred public policy objective of removing a disincentive for residents from states with a sales tax of less than 3 percent to purchase goods in Washington.”

When Rep. Stonier said this tax increase “moved pretty quietly through the system” she must have meant the House didn’t hold a public hearing on SB 5997 before voting on it (the House originally had a different bill, however).

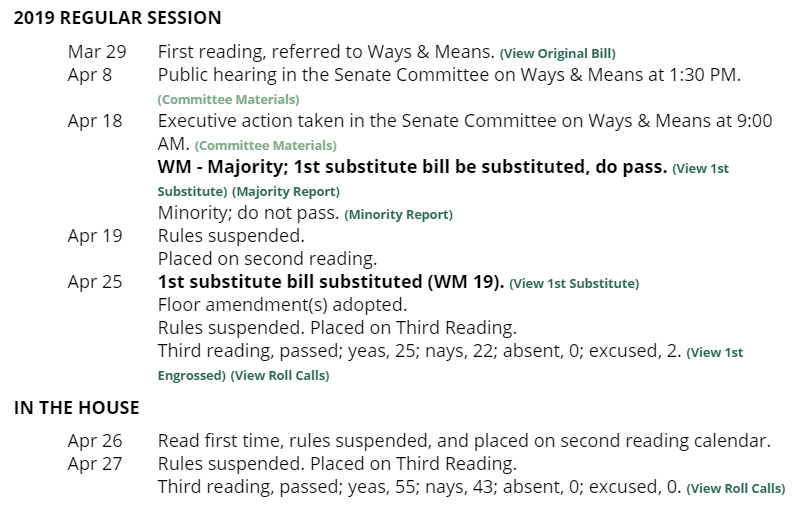

Bill history for SB 5997

Indicating that the legislature may not be done raising taxes in the near future, the budget also includes $2 million for the Department of Revenue to facilitate a tax structure study that is tasked with looking at the possibility of a corporate income tax among other things (Section 137 (2)(c)).

Lawmakers had an increase of $4.5 billion of forecasted revenue to grow the budget without imposing any tax increases. Instead they adopted a massive 17% increase in spending while imposing nearly $1 billion in tax increases. Though we’re told those tax increases were needed for education and healthcare spending, they are curiously close to the $970 million in compensation increases provided for in the budget.

Discussing why he voted against the budget crafted by his party, Sen. Mullet said:

“Unfortunately, the operating budget did not enjoy bipartisan support and relied too much on raising taxes. I agreed to raise taxes to support the wide-ranging transportation budget package in 2015, to support light rail in 2016 and to solve the McCleary lawsuit over K-12 education funding in 2017. But this year, it seemed we were raising taxes because we could, not because we needed to. I couldn’t support that, so I had to vote ‘no.’”

While the budget does comply with the four-year outlook, the ability to sustain this huge spending increase and not unduly damage those industries facing increased taxes, especially with economic warning signs on the horizon, will ultimately determine the true legacy of the 2019 session.