Today we released a new study on how Indian tribes use gas tax reiumbursements from the state to undercut non-tribal stations. Key findings from the study:

- New tribal gas tax compacts negotiated by the governor require tribal fuel station operators to collect the state’s full gas tax rate, but then state officials give back 75%, or 28 cents per gallon, to tribes.

- Since 2000, the number of tribal gas stations with agreements has more than tripled from an estimated 14 to 51.

- Under the new agreements, the amount of gas taxes given to tribes has grown exponentially, from $5.31 million in 2005 to more than $28.14 million in 2010.

- Since 2005, motorists lost more than $90.55 million in gas tax revenue to Indian tribes.

- Tribal fuel station operators are consistently underselling regional non-tribal competitors by an average of 7 to 12 cents per gallon for unleaded fuel and 15 to 26 cents per gallon for diesel in most areas of the state.

- Tribal station operators charge up to 11.5% less for fuel than their non-tribal competitors.

- In one example, a tribal station is estimated to have sold fuel at a loss of 2.5 cents per gallon.

- The compacts allow state gas taxes to be used for non-highway purposes, subsidizing general tribal services.

- Under the compacts, details of the tribal audits that are required to ensure compliance are kept secret from the public and state DOL officials.

- The compacts allow tribes to undercut private fuel station operators, give away needed revenue for roads, harm taxpayers by allowing gas tax revenue to be spent on non-highway purposes, and hurt non-tribal businesses by creating an unfair playing field among fuel station operators.

Washington state motorists would welcome lower fuel prices in today’s tough economy. The average price of fuel is near $4 per gallon. So when stations in Yakima, Spokane or Tacoma sell gas for less than their nearest competitors, consumers will notice and start filling up at the cheaper stations.

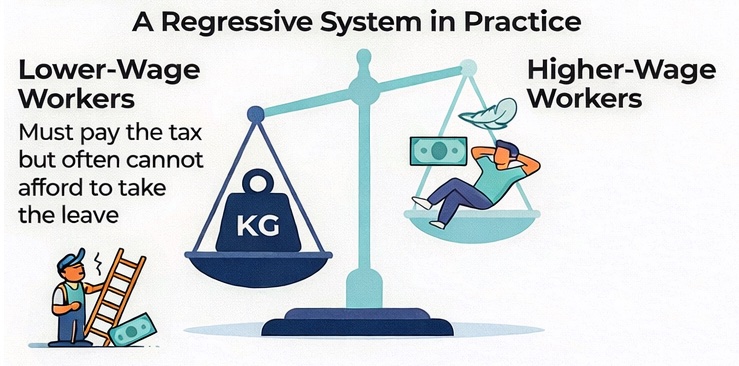

But what if those cheaper stations had an unfair advantage? What if they were able to undercut their competitors because the governor gave them back 75% of the gas taxes they collected? In Washington, motorists must pay 37.5 cents per gallon in state gas taxes. These gas taxes are collected at the pump and remitted to the state.

In 2007, the legislature passed Senate Bill 5272, which authorized the governor to enter into new fuel tax compacts with federally recognized Indian tribes who operated fuel stations in Washington state. The governor settled tax agreements with 23 Indian tribes. The new agreements require tribally owned fuel stations to collect the state’s full gas tax rate from motorists at the pump, but then state officials give back 75%, or 28 cents per gallon, to Indian tribes. Since 2005, motorists lost more than $90.55 million in gas tax revenue to Indian tribes.

Non-tribal station owners say the tribes use the public money to unfairly undercut competition by charging less for fuel. Indeed, most people know that tribal fuel stations are generally cheaper.

The tribal fuel compacts pose significant risks to private, non-tribal fuel sellers who must pay the full gas tax and charge their customers more for fuel. Non-tribal fuel station owners are forced to operate at a competitive disadvantage because of special tax treatment given to Indian tribes, and they ultimately risk being run out of business.

Washington Policy Center recently conducted a price survey of 18 tribal stations located in five metropolitan areas around the state. These areas are: Tacoma, Olympia, Bremerton, Spokane and Yakima. This research tested the idea that tribally owned fuel stations charge less for gas than their non-tribal counterparts.

During the month of July, WPC researchers compared the price of fuel at the 18 tribal stations with the regional and statewide averages determined by AAA’s Daily Fuel Gauge Report. The results show that tribal fuel stations — under the agreements negotiated by the governor — consistently undersell regional non-tribal competitors, with Spokane-area stations as a possible exception.

Read our full Policy Brief here and watch the KOMO 4 News story, which aired tonight.