Senate Bill 5291 is an “act relating to strengthening the WA Cares program by implementing the recommendations of the long-term services and supports trust commission.” Most of the bill’s provisions would simply move the deck chairs on the sinking WA Cares ship. However, I am a big supporter of one of the changes proposed and a fan of another. I have concerns or additions to a few of the recommendations, and I toss out a few hopes of my own.

Here is the testimony I gave to the Senate Committee on Labor and Commerce:

I’m Elizabeth New with the Washington Policy Center.

One of the recommended changes within SB 5291 is one I have been urging for years and am glad to see: Right now, most workers will need to have paid the WA Cares’ payroll tax for at least 10 years without a break of five or more consecutive years. This eligibility provision excludes many of the very caregivers we’re told WA Cares is here to help. Parents often take five or more years away from formal, W2 work, as do those caring for disabled or aging family members. The bill before you today gets rid of that five-year language. I like it.

I also like the idea of removing “employment sector” from the list of demographic information required in the Long-Term Services and Support Trust Commission’s annual report to the Legislature. Its usefulness does not justify the work requirement involved.

Moving on, the bill says, “An out-of-state participant who has elected coverage may not withdraw from the program after electing coverage,” and that the Employment Security Department must cancel an out-of-state participant’s coverage if he or she fails to make required payments or submit the required reports. I want lawmakers to ensure this applies to people who have moved out of state but choose to continue participation in WA Cares and has nothing to do with out-of-state residents who work for Washington employers and have so far failed to apply for a voluntary exemption. Also, workers who move out of the state and choose to continue with WA Cares need to be made fully aware of the reporting and bill-paying requirements that become their burden if they continue to participate.

Another recommendation is to make exemption from the program automatic for active-duty military service members with off-duty civilian work. Automatic exemptions should also extend to non-immigrant visa holders and out-of-state residents whose wages the state is taking. Right now, they are required to apply for an exemption. They may not know always know about that.

A recommendation within allows an exempt employee who previously attested to having long-term care insurance to rescind the exemption prior to July 1, 2028. If people want back into WA Cares, I think they should be let back in with the same eligibility requirements as others at any time.

I trust the long-term-care industry to offer good advice about the final recommendation to create supplemental long-term-care policies meant for workers when WA Cares dollars run out. What I like most about this is the acknowledgment that the amount of the lifetime benefit in WA Cares is inadequate. The state has been marketing WA Cares saying workers should have peace of mind about their possible long-term-care needs when they shouldn’t.

How about adding this?

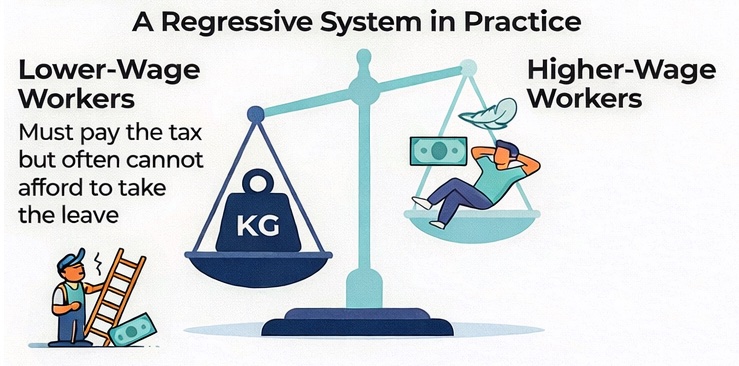

This bill should also include reopening the exemption for any worker who obtains long-term care insurance at any time. This would help provide people in need of long-term care with a more substantial benefit and help the state with fewer people applying for Medicaid’s long-term-care services. You should also offer people who work fewer than 500 hours a year reimbursement for non-qualifying tax payments.

Finally, this bill should include Rep. Peter Abbarno’s idea in House Bill 1026 about allowing spouses to share earned benefits.

Please let me know if I can provide any further information. Thank you.

* The full hearing is available on TVW here.