Senate Bill 5292 should concern every W2 worker in Washington state. The bill guarantees yet another pay decrease for workers of all income levels and need — and non-need — so some workers can take advantage of a pool of money filled by a payroll tax on workers’ paychecks. Then that pool is most often emptied by middle- and upper-income wage earners. Those with higher incomes are the ones who can better afford to take time off and receive a portion of their pay from fellow taxpayers to bond with babies or take care of medical needs, after all. (See more about PFML fund usage I compiled here and below.)

Lawmakers on a Senate committee are scheduled to vote on this bill concerning the paid family and medical leave program tomorrow, Feb. 27, possibly moving it closer to becoming law. The public can register comments about the pay-decreasing program or track the bill’s progress in the Legislature by signing up for email notifications here on the bill’s information page.

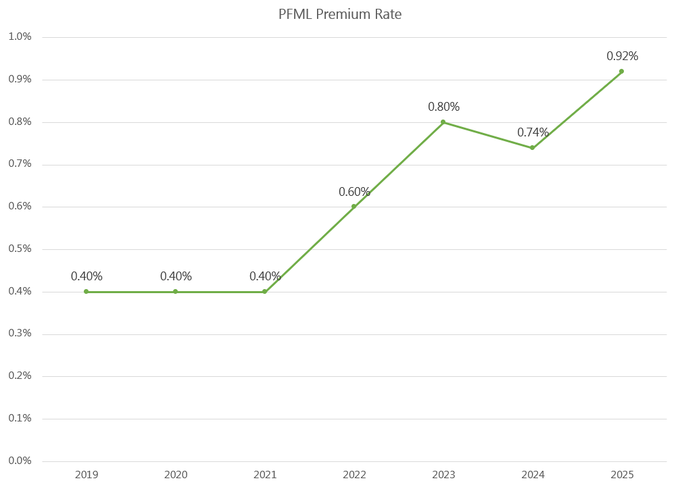

As the chart highlighted here shows, workers, including low-income ones, are paying more than double the amount they paid for this tax when the PFML program began in 2019. The tax is 92 cents on every $100 earned in 2025.

This bill will ensure workers are charged even more soon, up to the tax rate’s cap of 1.2%, by changing the way the tax is calculated and requiring more money in reserves so the program better pays its way. That’s something the program hasn’t been able to do and isn't expected to do in the future. An earlier version of SB 5292 would have taken away the already worrisome cap. I expect to see another attempt to bust the cap this session or in the near future.

The testimony I gave at a public hearing in the Senate Ways and Means Committee Feb. 25 follows:

Thank you, all, for your time. I’m Elizabeth New with the Washington Policy Center.

I believe workers would be better off if this Legislature ended the state’s paid-leave program, instead of adjusting how the tax is calculated and requiring more revenue for a reserve.

This program is not a safety net. It lowers the wages of workers at all income levels, benefits higher-income earners and limits people’s ability to meet other life needs. It also cannot pay its way.

Administrative costs and benefits exceeded revenue in two of the program’s first four years and a negative net income is expected again in future years.

I appreciate that the 1.2 percent rate cap is reinstated in this bill but worry that will be short-lived, as the bill’s fiscal note says the program will never establish a three-month reserve if subject to the cap.

More concerning, this program benefits higher-income workers at the expense of lower-income earners. In fiscal year 2024, workers making $60 or more an hour used the fund nearly twice as much as the lowest wage earners. Meanwhile, full-time workers of all incomes lose hundreds of dollars a year to this tax.

While some tout the number of workers helped by this tax, they ignore that millions of workers have not been helped and that many struggle more because of it.

Thanks for your time. I welcome any questions about what I hear from workers in the state about this burden.

—————

Calculate how much of your income goes to other workers for life wants and needs — at the expense of your own life needs — at https://paidleave.wa.gov/estimate-your-paid-leave-payments/.