Washington State Office of Fiscal Management (OFM), yesterday released its updated tax revenue projections through 2029, reducing estimated tax collections by $845 million. For the biennium 2023-2025, tax revenues are anticipated to increase by $54.4 million.

Over the next four years, the state is expected to collect an additional $10 billion in tax revenue, ending the 2027-2029 biennium at $76.42 billion.

Additionally, transportation tax revenue is expected to climb by $284 million during the same time period.

OFM considers this a slowing in the tax revenue growth for the state.

Several factors are putting downward pressure on collected tax revenues, including an anticipated decrease in the cost of a barrel of oil from $71 this quarter to $63 per barrel in 2029.

In Washington job growth was stronger than expected with manufacturing employment increasing by 31,500 jobs in the last few months with Boeing workers returning to work after a strike in the fall. Hiring at state and local governments added 5,200 new positions.

Washington unemployment is 4.6% which ranks Washington 20th in the nation. This is an improvement from August last year where the state ranked 7th worst in the nation. Job growth expectations have been revised down from 0.9% to 0.8% with an anticipated increase in unemployment to 4.9% this year before returning to 4.4% in 2029.

Housing costs in the greater Seattle area are predicted to continue to increase at around 5% this year. New housing starts are steady with 40,200 permits issued in January and will fluctuate minimally (between approximately 38k and 42k) over the next few years. Pre-pandemic housing permits were 15-20k higher with the economy not having fully recovered from government mandated shutdowns during COVID which halted many construction projects.

Personal income for Washington residents has decreased relative to the rest of the United States but is expected to grow by an average of 5.4% over the next 4 years.

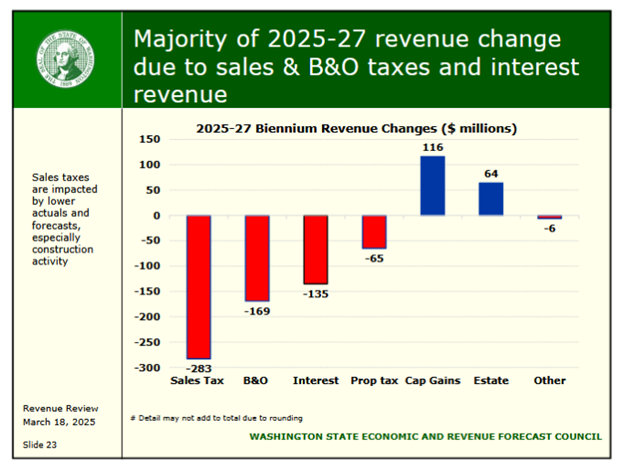

Sales tax and Business and Occupation taxes (B&O) have significantly dropped, being offset by the new capital income tax collections and estate taxes.

Tax revenues are continuing to grow, but the decline in the rate at which state tax collections are occurring will not help with the expansion of tax spending currently proposed by the legislature during the current legislative session. With a reduction in estimated tax collections, legislators need to carefully consider which programs to curtail or eliminate.

The legislature is consistently spending more than the tax revenues collected, causing the state budget to almost double in the last 10 years. When tax revenue growth was predicted at 4.5% per year, programs were created and funded in future years assuming the growth would continue, and subsequent revenues would appear, are now in jeopardy.

Instead of reducing spending numerous tax proposals were introduced by the majority party, to cover the shortfall. Many of these have already failed but could be re-introduced as budget provisos in the coming weeks.

Washington doesn’t have a tax revenue problem; it has a spending problem.