Click here for a .pdf of this blog

We’ve already established that every state revenue department across the country describes capital gains as income and those that tax capital gains do so via their income tax codes. In fact, no state has an “excise tax” on capital gains and only those states with income taxes tax this form of income.

Further clarifying the tax treatment of capital gains income the federal Internal Revenue Service says:

"You ask whether tax on capital gains is considered an excise tax or an income tax? It is an income tax. More specifically, capital gains are treated as income under the tax code and taxed as such."

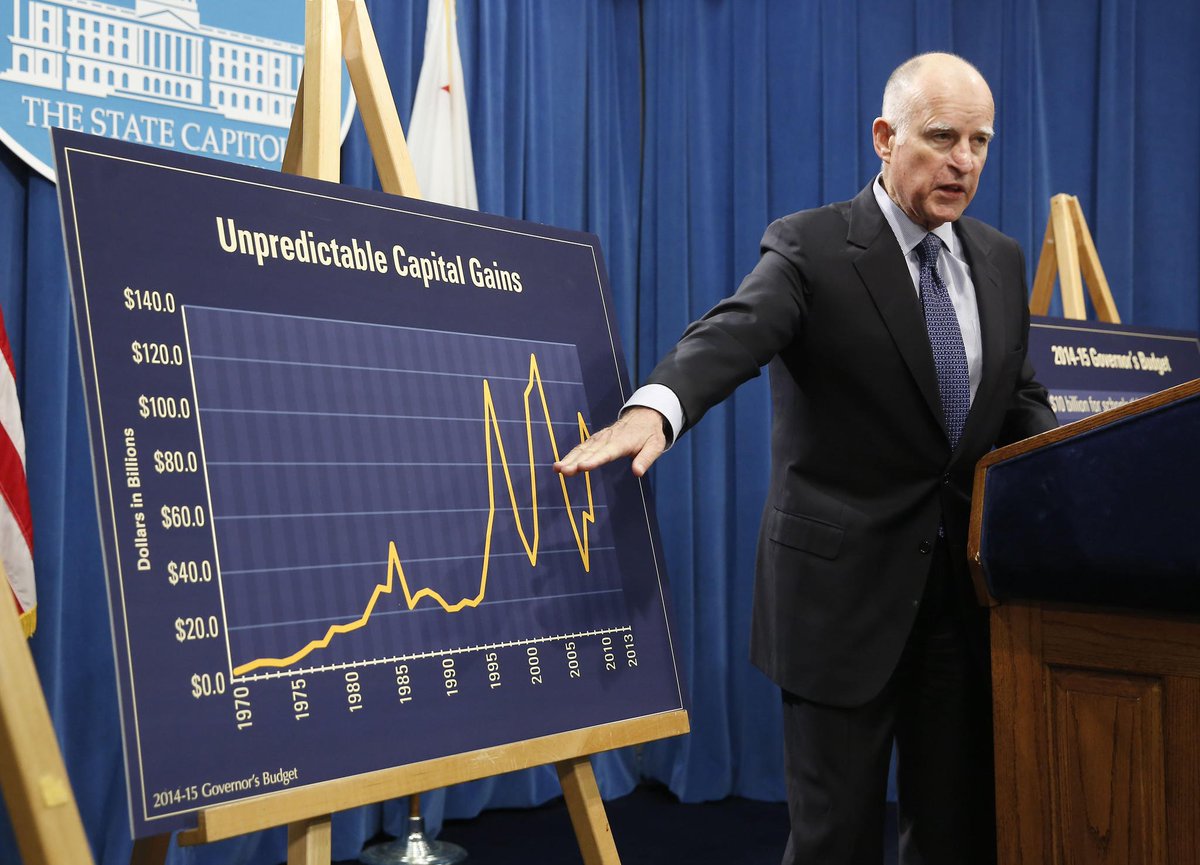

With this undisputed fact in mind, have capital gains income taxes been a dependable source of revenue for state budgets?

To answer this, this summer I asked each states’ tax officials this question about their capital gains income taxes:

“Has this source of state tax revenue been dependable and stable or is it generally more volatile and unpredictable?”

Not a single state said capital gains income taxes are dependable and stable. Here are a few examples instead discussing the volatility problems inherent with taxing this type of income:

- Delaware: “In Delaware, capital gains are taxed under the personal income tax as all other income. As in every other state, capital gains are extremely volatile and unpredictable. This is particularly problematic toward the end of market cycles, when they represent a greater share of personal income tax revenues.”

- Massachusetts: “For the Commonwealth of Massachusetts, taxes on capital gains are among the most volatile and unpredictable major sources of revenue. Obviously, that is very much in line with the experience of other states."

- Iowa: “In Iowa, where capital gains are taxed like any other income source, capital gains income is generally more volatile and unpredictable than other sources of income -- such as wages and interest.”

- California: "California's tax revenues have numerous volatile elements, but among the more significant sources of revenue volatility are the state's tax levies on net capital gains through the personal income tax."

- Nebraska: “For the state of Nebraska, the personal income tax on capital gains are very much volatile and unpredictable. This is expected since capitals gains are the easiest form of income that taxpayers can shift between tax years hence making the tax planning easier.”

- Virginia: “Capital gains is the most volatile tax source that any state has to forecast. It is not dependable or stable.”

The extreme volatility of capital gains income taxes is well known by tax experts. When issuing Washington’s August 2019 bond credit rating Standard & Poor’s noted:

“Washington's revenues have historically exhibited less cyclicality than others (due in part to the lack of a personal income tax) . . . we have observed that capital gains-related tax revenues are among the most cyclical and difficult to forecast revenues in numerous other states."

Washington’s Department of Revenue also warned in 2012:

“Capital gains are extremely volatile from year to year.”

It is also important to remember that the state’s Department of Commerce says not having a capital gains income tax “is great marketing” for Washington. If imposed, Commerce cautioned this would mean “one less tool that we have in our economic development tool box.”

Here are direct quotes from each state discussing the volatility problems with capital gains income taxes:

- Alabama: “As reported on Alabama returns, capital gains (or losses) are not distinguished from other types of non-wage income. As a result, we are unable to provide a statement regarding variations in this revenue source.”

- Alaska: No capital gains income tax

- Arizona: “As you might expect, capital gains income is generally more volatile than other sources, like wage income. This can be clearly seen in historical Arizona income tax revenues.”

- Arkansas: “Capital gains are largely treated as one-time gains in the conservative revenue and budget projections for Arkansas.”

- California: “California’s tax revenues have numerous volatile elements, but among the more significant sources of revenue volatility are the state’s tax levies on net capital gains through the personal income tax.”

- Colorado: “In Colorado, capital gains contribute to the volatility in state revenue. Colorado's current state tax data reporting system does not allow analysts to isolate capital gains taxes from other sources of income tax revenue in real time. Instead, analysts must rely on federal data from the IRS, which is released with a two-year lag.”

- Connecticut: “Capital gains is one of our most volatile sources of revenue. We have seen large swings in collections since the inception of the tax based on taxpayer behavior and investment performance. As a result, in 2017, our state implemented a volatility cap, which establishes a base amount of revenue for certain revenue streams which are highly influenced by capital gains, and any amounts over that threshold are to be deposited in our Budget Reserve Fund until we grow our savings to 15% of expenditures- at which time the excess revenue is used to pay down our long term debt obligations.”

- Delaware: “In Delaware, capital gains are taxed under the personal income tax as all other income. As in every other state, capital gains are extremely volatile and unpredictable. This is particularly problematic toward the end of market cycles, when they represent a greater share of personal income tax revenues.”

- Florida: No capital gains income tax

- Georgia: “Capital gains are a relatively small portion of the personal income tax base in Georgia, even in good years, but they can have an outsized effect on the volatility of the state’s largest revenue source. A 75% drop in reported gains from 2007 to 2009 explains about two thirds of the drop in reported gross income over the same years. Even during the expansion, reported gains remain volatile, falling by as much as 18% and rising by as much as 60% in any given year.”

- Hawaii: “Like the other states, tax revenue from capital gains is volatile and unpredictable.”

- Idaho: “Capital gains tax revenue is generally more volatile and unpredictable.”

- Illinois: "Capital gains income has experienced extreme volatility in recent years for Illinois."

- Indiana: “There is no way of differentiating capital gain income from other sources of income from DOR return data. With that stated, it appears at first glance that Indiana’s volatility is largely in sync with reported amounts for federal purposes.”

- Iowa: “In Iowa, where capital gains are taxed like any other income source, capital gains income is generally more volatile and unpredictable than other sources of income -- such as wages and interest.”

- Kansas: “State Capital Gains Tax is viewed as unpredictable and volatile.”

- Kentucky: “In Kentucky, where capital gains are taxed like any other income source at a flat 5%, capital gains income is generally more volatile and unpredictable than other sources of income -- such as wages. During the 2008 great recession, many states had a crash in their income taxes and blamed capital gains (due to the market crash). In Kentucky, income taxes fell but withholding was the primary driver – and – we did not fall near as much as the Northeastern states. This suggests that Kentucky may have a smaller ratio of capital gains to other taxable income, giving our income tax a little more stability since capital gains are the most volatile source of taxable income.”

- Louisiana: “Louisiana taxes capital gains in the same manner and at the same rates as other sources of income. Louisiana also provides an individual income tax deduction for net capital gains from the sale of a Louisiana business.”

- Maine: “Maine does not have a capital gains tax as such. Instead, capital gains which are included in the federal adjusted gross income are taxed at the regular income tax rate, and so are not taxed separately as a discrete revenue source. Maine’s tax return begins with the federal adjusted gross income, and the composition of that figure is not broken down further because it is all taxed in a uniform manner. The tax rate is only dependent on the taxable income amount and the filing status.”

- Maryland: “We don’t believe that we have anything to add beyond the quotes you have below. We would just be repeating what other states have said. Virginia’s quote says it all.”

- Massachusetts: “For the Commonwealth of Massachusetts, taxes on capital gains are among the most volatile and unpredictable major sources of revenue. Obviously, that is very much in line with the experience of other states."

- Michigan: “In Michigan, we start with federal AGI (Adjusted Gross Income), so capital gains are included in the tax base. However, we do not separately forecast capital gains from other payments.”

- Minnesota: “Minnesota taxes capital gains at the same rates as ordinary income. Although capital gains are one of the most volatile types of income, they make up less than 10 percent of the individual income tax base in Minnesota. Over the ten-year period from 2008 to 2017, the year-over-year change in capital gains was as high as +89% and as low as -55%. The overall income tax base was much more stable, with a range of +11% to -9%. The significance of capital gains varies with economic conditions. In recent years, capital gains have made up between 6.0% and 8.4% of taxable income, but in 2009 (during the great recession), they represented only 2.9% of taxable income.”

- Mississippi: “Mississippi taxes capital gains as ordinary income and does not provide a separate tax rate for the capital gains. As such, the income from capital gains are more volatile and unpredictable than other sources of income.”

- Missouri: “Capital gains are exceedingly volatile from year-to-year. The direction of the stock market may give an indication for the direction of capital gains collections, but the magnitude of such collections is extremely hard to forecast.”

- Montana: “Montana taxes the capital gains income of individuals and corporations through its personal income tax and corporate income tax. For the personal income tax, individuals report the same amount of capital gains (or losses) that was reported on the taxpayer’s federal income taxes. This income is taxed similarly to other taxable income. Over time, the amount of capital gains income reported by Montana’s full-year residents does tend to increase and decrease significantly more than all income combined.”

- Nebraska: “For the state of Nebraska, the personal income tax on capital gains are very much volatile and unpredictable. This is expected since capitals gains are the easiest form of income that taxpayers can shift between tax years hence making the tax planning easier.”

- Nevada: No capital gains income tax

- New Hampshire: No capital gains income tax

- New Jersey: "Capital gains income is taxed similarly to other sources of income in New Jersey. Estimating New Jersey gross income tax revenue (GIT) is inherently subject to uncertainty and volatility. GIT revenue growth is highly influenced by the performance of the financial markets, which impacts high-income taxpayers through capital gains, certain kinds of business income, as well as bonus income."

- New Mexico: “Volatility is minimized due to New Mexico Personal Income Tax revenue being a relatively small tax source compared to many other states and the percent of NM AGI from Capital Gains is also lower than most states.”

- New York: “The most volatile components of taxable income are bonuses and capital gains realizations. Unlike the primary drivers of personal income – employment and wages, which have relatively stable bases – income from capital gains realizations can rise and fall dramatically.”

- North Carolina: “North Carolina taxes capital gains realizations as ordinary income, like most other states. Taxable income from capital gains realizations is more volatile and more difficult to forecast than other types of income due to the underlying volatility of capital income and the considerable discretion taxpayers have over when to realize capital gains and losses.”

- North Dakota: “North Dakota’s situation is no different from any other state in regard to the ability to forecast revenue from capital gain transactions. We do not have a better crystal ball, despite how diligently we polish it. As with other states, there’s historical data that might be available to indicate past activity and perhaps provide limited use in trying to predict future trends/behavior, but that’s a very gray area .... I would like to be able to say North Dakota has figured it out, but that won’t be today."

- Ohio: “Ohio does not have a capital gains tax. Capital gains income is subject to the Ohio income tax.”

- Oklahoma: “Oklahoma’s individual income tax starts at federal AGI (Adjusted Gross Income); capital gains are subject to Oklahoma income tax to the extent they are included in federal AGI at the same rates as ordinary income. Oklahoma allows a deduction for certain qualifying capital gains that are included in federal AGI. Oklahoma does not separately forecast capital gains.”

- Oregon: “Capital gain is one of the components of income included in the computation of the Oregon personal income tax. There isn’t a separate Oregon tax just for capital gains. Wage income, investment income, capital gains and business income, in general, follow the trends of economic conditions, with capital gains being the most sensitive. Because of the volatility of capital gain income, its share of gross income changes greatly.”

- Pennsylvania: “Pennsylvania law does not have a concept of ‘capital’ gains and instead ‘net’ gains are taxable. For statistical information related to Pennsylvania’s personal income tax, please review our PIT booklets.”

- Rhode Island: “Rhode Island taxes capital gains like any other source of income including wages, salaries, bonuses, etc. Although Rhode Island does not separately track the amount of personal income tax generated by capital gains income, the forecast of capital gains realization for the state has shown more volatility than other sources of income such as wages.”

- South Carolina: “In South Carolina, the net capital gains tax can fluctuate wildly.”

- South Dakota: No capital gains income tax

- Tennessee: No capital gains income tax

- Texas: No capital gains income tax

- Utah: “Utah does not have a separate capital gains tax. Capital gains are taxed at the regular personal income tax rate of 4.95%, along with all other taxable sources of income. Capital gains are not reported separately on Utah's individual income tax return. They are included in federal adjusted gross income (FAGI), which is the starting point for Utah individual income tax. Capital gains often vary significantly year to year.”

- Vermont: “It is a volatile source but we’ve never measured revenue from capital gains alone so we don’t have that quantified.”

- Virginia: “Capital gains is the most volatile tax source that any state has to forecast. It is not dependable or stable.”

- Washington: No capital gains income tax

- West Virginia: “State capital gains taxes would be somewhat volatile and unpredictable. Due to relative income distribution, West Virginia relies less on this source of funding than most other states.”

- Wisconsin: “In the last twenty years, wages and salaries have comprised about 73% of total adjusted gross income (AGI) for Wisconsin residents while net capital gains have comprised about 5% on average. However, capital gains have historically contributed an outsized share to year over year changes in AGI. In the last twenty years, wages and salaries have comprised about 47% of the year over year change in AGI, while capital gains have comprised about 29% on average. Wisconsin does not provide special rates of taxation for capital gains relative to other income, but does provide a partial exclusion for long-term capital gains (60% prior to 2009 and 30% after 2008). That clearly reduces individual income tax revenue from capital gains, but also reduces revenue exposure to capital gains fluctuations.”

- Wyoming: No capital gains income tax

Additional Information

IRS: Capital gains tax "is an income tax"

State Revenue Departments Describe Capital Gains Income Taxes

WA Department of Commerce: No state income tax "is great marketing" for Washington

A Capital Gains Tax IS an Income Tax: Irrefutable Proof in About Two Minutes (short video)

BAD POLICY: An Income Tax on Capital Gains for Washington (short video)