The well-respected Washington Research Council just released an economic analysis of Initiative 2109, the citizen-led ballot measure to repeal the capital gains income tax.

The study finds that if Initiative 2109 passes it would have minimal impact on the state’s ample revenue collections. The study notes that repeal would reduce future state revenues by only $424 million in 2024, and $820 million in 2025, and thus would not in any way reverse the rising rate of state tax collections. Lawmakers have so much money they added another $2 billion to state spending just a few months ago.

So opponents’ claim that the initiative would “cut” funding for “K-12 education and daycare” is false. That’s because state tax collections will continue to increase without the capital gains income tax. Even if the initiative passes, expect lawmakers to add another several billion in funding to state programs in the 2025 session.

Second, the Research Council finds that capital gains income tax revenue accounts for only about 1% of estimated general fund revenue (NGFO or Near General Fund Outlook). That means passage of Initiative 2109 would have negligible impact on Washington’s public finances.

Some lawmakers wail that losing the capital gains income tax will “devastate” (their word) state programs. As any budget planner from the kitchen table to a multi-national company knows, if you can’t handle a 1% reduction among rising revenues you should turn the finances over to someone else.

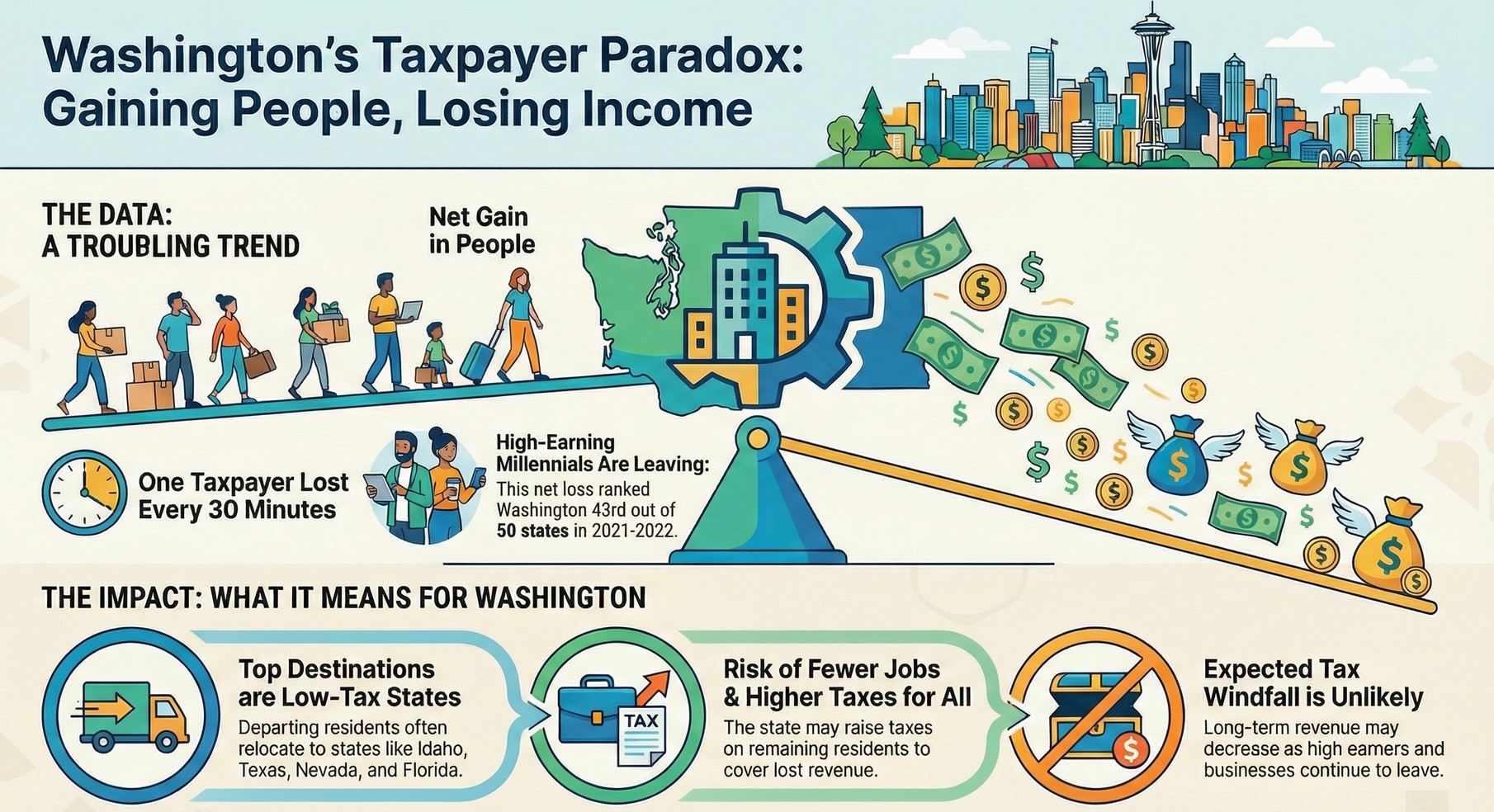

The more we learn the more we see just how small the impact of ending this new tax would be. In fact, recovering our state’s no-income-tax status would likely bring far more benefit both to economic growth and to state finances.

The full Research Council analysis is just five pages and is well worth a look.