Legislators made workforce issues one of their priorities this past legislative session. So how’d they do? Well —

The mandate remains

The Legislature ignored my advice to tackle a big, easy, sensible solution for the state workforce. The Department of Transportation, Washington State Patrol and other agencies’ staffing challenges will not be helped by Gov. Jay Inslee’s misguided, outdated COVID-19 vaccine mandate on new hires. Even so, only a small minority of lawmakers went after the policy or tried to make amends with workers the state treated like second-class citizens, even after we knew people who were vaccinated and those who weren’t could spread and contract COVID-19.

It wouldn’t have been easy to take down the punitive policy. The governor did a good job making the mandate seem ironclad, weaving it into state law, without legislative approval and despite questionable authority, and putting it into a contract negotiation with labor. C’mon, unions. Please stand up for your workers like you say you do. Washingtonians who are still being discriminated against and stigmatized because of the governor’s bad policy deserved more. So did our state workforce.

As years go on, how will it look to still be excluding a sizable portion of the workforce? This “permanent” vaccine mandate is going to age badly.

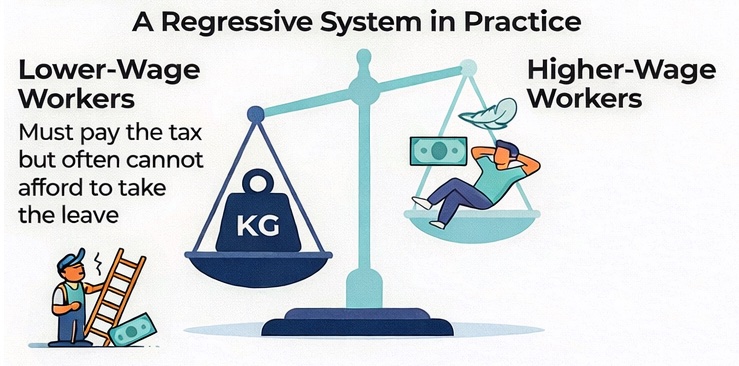

Long-term-care payroll tax

I was ignored on this one, too, as were 31 Republican members of the House of Representatives who sponsored House Bill 1011 to repeal a coming payroll tax. The tax is going to help state budget writers with long-term-care costs that are gobbling Medicaid funds, though the program being created doesn’t really help any workers in the state. Don't be fooled. Instead, workers — low- and high-income ones — are going to be penalized just for being working workers, with an additional 58 cents for every $100 they make taken from their paychecks starting in July.

Supporters of the cost-shifting plan, and state agency workers administering the tax for a fund called WA Cares, clearly hope that if they keep telling Washington workers they should like WA Cares, they will. I don’t think that’s going to work out. The more people learn, despite an aggressive, misleading state marketing campaign, the more they don’t care for the WA Cares Fund. Read more about the tax on the way here. And read more about “voluntary” exemptions available to a small portion of workers here.

Licensure

Research from the Institute for Justice found that Washington state requires government licenses to work in a larger number of job categories than any other state. Although the number of days lost in Washington is less than average, Washington’s total burden of occupational licensing ranks 8th worst in the nation.

Instead of getting rid of bureaucracy that slows workers down and erects barriers, lawmakers nibbled around the edges in some areas of licensing. Some easement came for military spouses in House Bill 1009. It expedites licensing for military spouses who have qualified occupational licenses in other states. It also allows a military spouse to terminate an employment contract without penalty if his or her spouse receives orders for a permanent change of station.

Interestingly, a section in the bill report devoted to background explains Washington state’s many layers of licensing barriers. There are more than a dozen different agencies that regulate a plethora of occupations. We need to make it less cumbersome and costly to get to work in Washington state.

That will be happening more in health care when it comes to nurses. The Legislature finally passed legislation to become part of the multistate Nurse Licensure Compact. That will put patients in Washington state in a safer position in times of nursing shortages or pandemics, allowing nurses from 37 other states to work in Washington when needed. And it allows nurses here a license that acts more like a driver’s license. Good job, lawmakers.

Legislators also expanded scopes of practice in some areas. That will not only help supply patients with more access to care, but it will allow people to advance their careers in different ways. (Read more about workforce issues in health care in my blog, “2023 Legislature on health care: What passed? What didn’t?”)

Misguided moves

Disappointment came in Senate Bill 5236, which has the state intervening in hospital workplace situations it knows little about and questioning the judgment of professionals in the field.

House Bill 1200 is invasive and a favor to unions that comes at the expense of workers’ privacy. It will require public employers to provide employees’ personal contact information to exclusive bargaining representatives at regular intervals. That’s not cool.

Public employers have extensive access to employee information. It’s no wonder law enforcement officers had strong privacy concerns with the bill. Teachers might, too. Anyone who has been a union-represented employee but who doesn’t always agree with a union knows that life can get uncomfortable if you’re seen as someone who opposes a union’s workplace or political ideas. Unions don’t need to be sending messages to workers’ private mobile phones without their permission.

More disappointment came in House Bill 1106. That bill will raid money from the unemployment benefits meant to provide workers with temporary income when they lose a job through no fault of their own. With HB 1106, when a worker quits because his or her life and kid schedule don’t line up with work, unemployment insurance benefits can go their way, too.

Expanding access to unemployment insurance benefits by adding circumstances in which a person can voluntarily quit is a bad idea. How many life choices and unexpected expenses in life will state taxpayers be responsible for financially? Workers, many of whom are not choosing to become parents, and many who have already raised children, as well as employers, already provide money to other people who want to take time off to welcome a new family member. That happens through the state’s Paid Family and Medical Leave (PFML).

A needed housekeeping item was rightly addressed for that state-imposed program Washington workers are forced to pay into but many will never benefit from. SB 5286 modifies the payroll tax’s funding formula to help it pay its way better in the future. The new formula is expected to help keep the program out of the red — that is, along with the unfortunate doubling of the payroll tax's rate and a recent $350-million legislative bailout from the general fund. (SB 5286 is bipartisan and helpful, but it’s not at all celebratory. It simply rearranges deck chairs on the PFML Titanic.)

Thankful miss

Luckily, House Bill 1045 bit the dust. It was an insult to all workers. It would have established a basic income pilot program, “providing 24 monthly payments to up to 7,500 qualifying participants in an amount equal to 100 percent of the fair market rent for a two-bedroom dwelling unit in the county in which a participant resides,” explains a staff bill report. People receiving our tax dollars through the pilot program would retain their eligibility for tax dollars available to them in other assistance programs.

HB 1045 had a hearing on January 11, was given a majority pass out of the House Committee on Human Services, Youth, & Early Learning on January 24, and then rightly met its death awaiting action in the House Appropriations Committee.

Summing up

The legislative session offered a mixed outcome for workers. It included a long-sought common-sense solution and some fixes to state limitations on various workers. But it was painful to watch lawmakers toy with misguided proposals while missing several opportunities to make Washington a better place to live and work.