Supporters of the state’s tax on CO2 emissions, known as the Climate Commitment Act (CCA), claim the revenue created by the tax is necessary to fund projects that reduce the risk of climate change.

So, how much will the more than $2 billion in new state spending reduce Washington’s CO2 emissions? They don’t know. And they aren’t interested in finding out.

During The Seattle Times editorial board debate on I-2117, which would repeal the CO2 tax, members of the board raised concerns about the lack of transparency and accountability for how the CCA money was being spent.

As editors noted in their fact check on the debate, “There is no exact tracking of the effectiveness of spending on initiatives paid for by the act.” The word exact in that sentence isn’t necessary. There is no tracking of the effectiveness of spending at all.

One of the authors of the CCA, Rep. Joe Fitzgibbon, admitted there was no tracking of how effectively the tax revenue was being spent. Spending decisions would be made politically, not based on effectiveness.

The Seattle Times writers explained, “Fitzgibbon told the board the accountability is at the feet at the Legislature, whose members spend what is raised in the act’s carbon auctions. Don’t like their choices? Vote them out.” How can voters do that when neither the legislature nor the governor’s office provide voters with the information they need to make judgments about the effectiveness of the legislature’s spending choices?

For example, the most recent data on the state’s CO2 emissions is from 2019. This is in violation of state law which requires emissions to release “total emissions of greenhouse gases for the preceding two years,” by “December 31st of each even-numbered year...” Data for 2020 and 2021 should have been released by the end of 2022.

How are voters supposed to judge legislators by the results when the results are hidden?

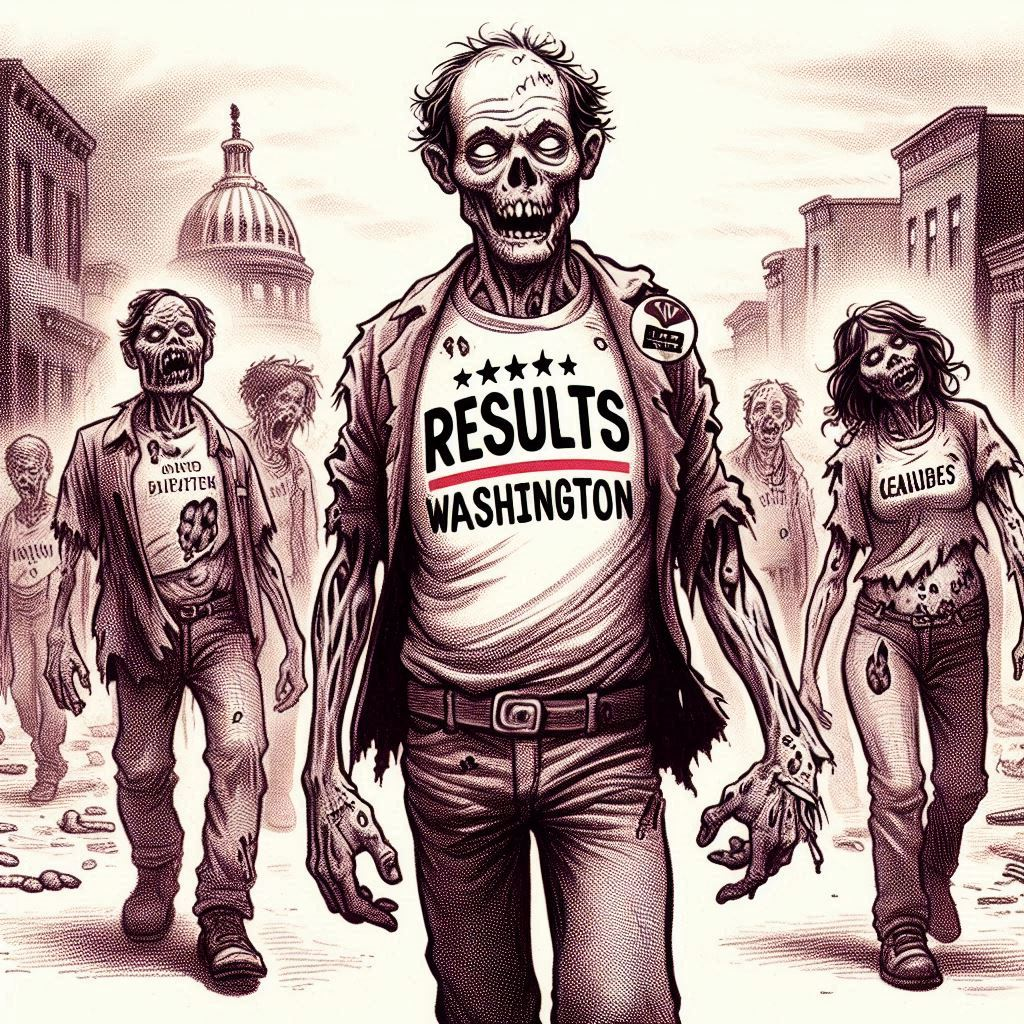

Previously, Governor Inslee promised his administration would be transparent about the results of his policies. That is not the case anymore. The governor’s accountability program Results Washington isn’t functional and provides no useful data on the state’s climate policy.

When Times editors asked the governor’s office about the lack of transparency, “Mike Faulk, spokesman for Inslee, said the Results Washington site is alive and well, and will continue to post metrics about climate investments, as well as other numbers.”

Far from “alive and well,” the state’s tracking of climate data is the walking dead. The data are badly out of date, useless as a tool for decision-making and leave out measures for many promises made by the governor where the state is falling far short.

For example, the most recent data on Results Washington for “Annual GHG [greenhouse gas] emissions” is from 2019. Results Washington also lists “Electricity from renewable energy sources” from 2020. The last climate metric is “Electric vehicles registered in Washington state.” The number is from 2022, despite the fact that data for total registrations are available through 2023 and new registrations are available through July 2024.

Put simply, the governor’s office doesn’t care enough even to provide data that are up to date. Data that are anywhere from two to five years old are not useful for decision making or for accountability.

Although there is no effort to track the effectiveness of “climate investments,” the governor’s office quickly spent taxpayer dollars to finish a web page showing the projects being funded by CCA tax revenue, including being able to sort projects by legislative district. That page does not contain any data about the success of these projects or any past projects. Nor is there an option to show projected environmental benefits. Just how much money is being spent, the name of the project, and where.

As the last 11 years of failing to meet our CO2 targets demonstrate, however, dollars spent are not an environmental metric.

Much of the debate about I-2117 and the CCA has focused on the high cost of the CO2 tax. Supporters of the tax could respond by saying the billions of dollars in new taxes are being spent effectively. The fact that they don’t even have a system to track the impact of that spending indicates that isn’t really the goal.