State spin about Washington’s long-term care law is churning.

Today, the state announced the “Long-Term Services and Supports Trust program now has an official name – the WA Cares Fund!” While “Long-Term Services and Supports Trust” was a mouthful that has been tripping me up in interviews and speaking events, it was more informative than the name is now.

The “WA Cares Fund” is a vague rebranding of something the state shouldn’t have to sell. If taking money out of workers’ paychecks to the tune of 58 cents per $100 of income was good for workers of all ages and incomes to gain a $36,500 lifetime benefit for long-term care, we’d all be eager to sign up and wouldn't need to be forced to join.

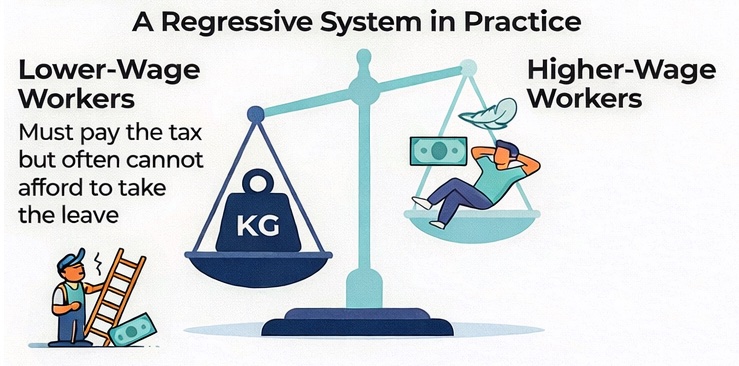

It’s not good for all workers.

Lawmakers created this fund to have workers defray long-term care costs associated with Medicaid. Even low-income workers don't win and will watch their income go down 58 cents per $100 of earnings starting in January. And since $36,500 in lifetime benefits is insufficient for care that typically costs at least double that amount every year, they won’t have much to feel safe about.

Instead of using its bully pulpit to encourage Washingtonians to start planning for their long-term care needs, it seems the state thought it’d be easier to take money from workers’ paychecks, create a socialized program and say, “WA Cares!"

The rebranding is accompanied by a new website (www.wacaresfund.wa.gov/). The site gives a sales pitch and bare-bones information about the state’s plan, in a one-sided format that is entirely inappropriate. The worst thing about the site might be that opt-out information is buried in a tab titled “private insurance," and it does not give a viewer resources or information about other options. It also buries the fact that you won't receive the benefit promised if you are no longer a resident of the state when you need long-term care — despite paying in hundreds or (more likely) thousands of dollars into the program during your working years. Since the benefit is not portable, a private plan and opting out will be a better choice for those who don’t think they’ll stay in the state for their retirement years.

Keeping workers in the dark and paying into the program can help keep the fund solvent, of course. Why would the state want people to understand how the program does and doesn’t work? A worker making $50,000 annually pays in $290 a year, a person making $100,000 will pay in $580 a year and so on. There is no cap.

Don’t count on the payroll tax staying at 58 cents per $100, either. There is a pattern of long-term care costs going up yearly, and we are expecting a silver tsunami. That’s another reason to check into your options.

Private market insurers can offer Washingtonians plans that might — or might not — work better for a worker, depending on his or her age, income and future plans. Call around for comparisons.

Do so quickly, as time is at a premium. Lawmakers just imposed a Nov. 1 purchase-by date for people hoping to opt out of this program and its associated payroll tax.