In what seems to be almost a weekly occurrence, the Employment Security Department (ESD) has again shown its disrespect for Washington employers by providing vague (and late) guidance on unemployment tax rate changes for 2022.

Employers need stability in operational costs, including predictable tax rates, in order to manage cash flow and pay their employees and costs on time.

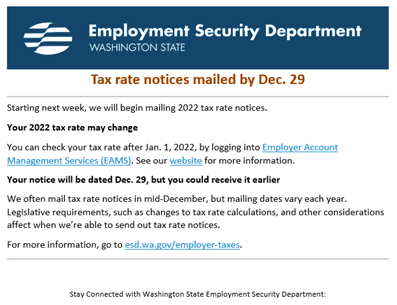

ESD typically sends the new unemployment tax rates to employers early in December which allows employers to craft budgets for the following year. This year, however, ESD is opting to release the rates on January 1, 2022, and notifying employers December 29, 2021.

This is another unacceptable decision by ESD that has significant impacts on employers. For employers that run payroll early in the month, changing the rates so late will cause delays in system updates and potentially employee checks.

ESD officials need to provide the public with more transparency into its internal policies, improve reporting accuracy, data timeliness and data availability. For employers, reporting tax rates for the next year as soon as possible, including regular bicameral legislative oversight of ESD, will help restore confidence in the embattled department.

For all of the Washington Policy Center recommendations for ESD, read the full Policy Brief here.