Looks like lawmakers caught a budget leprechaun. State revenues are now projected to have returned to pre-pandemic levels with more than a $3 billion increase projected at today’s revenue forecast. That's a serious St. Patrick’s Day pot of gold. It is time for talks of imposing a constitutionally suspect income tax on capital gains to stop.

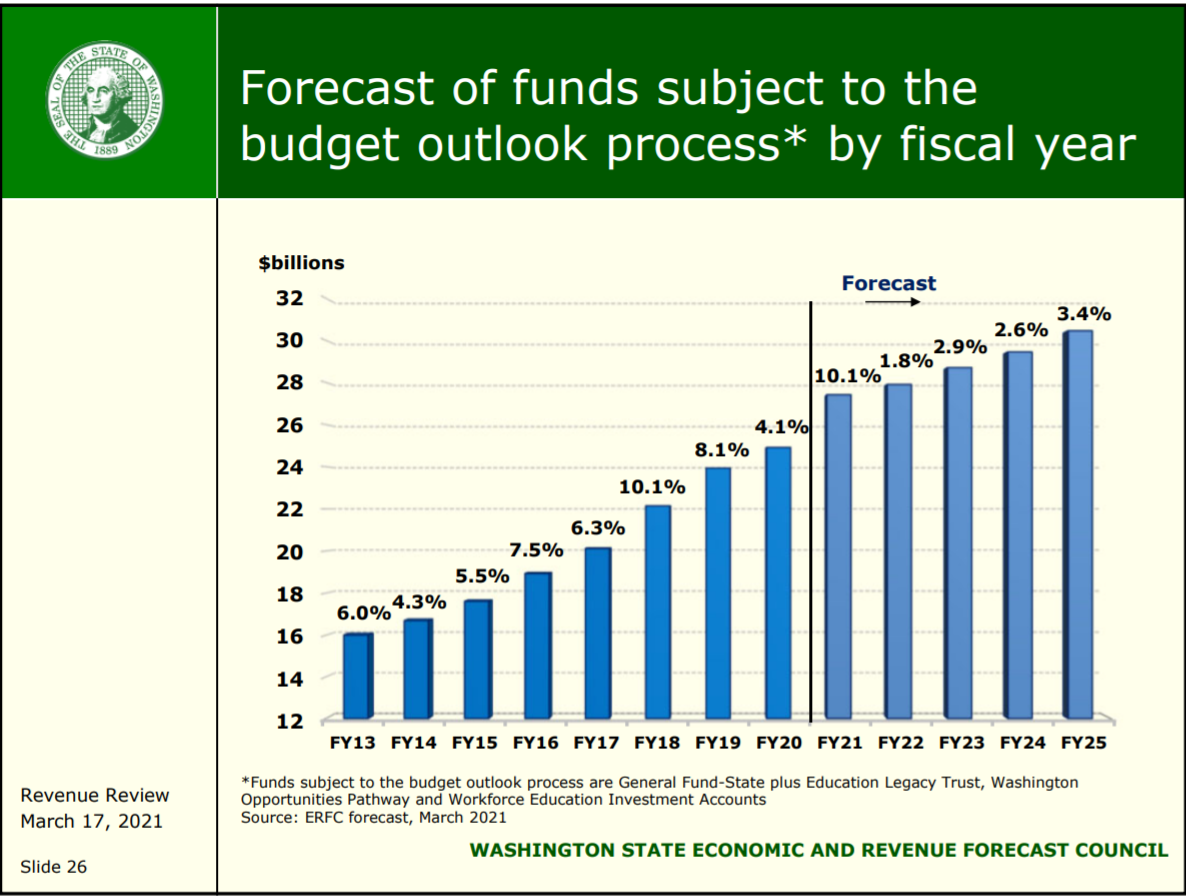

From today’s revenue forecast:

- “Total state revenues are expected to grow 13.6% between the 2017-19 and 2019-21 biennia and 8.2% between the 2019-21 and 2021-23 biennia”

- “The forecast of funds subject to the budget outlook is increased by $1,340 million for the 2019-21 biennium and $1,949 million for 2021-23 biennium”

Here are the forecasted revenue collections:

- 2017-19: $46.1 billion (18% increase)

- 2019-21: $52.3 billion (13.6% increase)

- 2021-23: $56.6 billion (8.2% increase)

- 2023-25: $59.9 billion (5.8% increase)

Along with ending efforts to impose an income tax, can we also transition away now from talk of any tax increases to a tax cut conversation instead?

Sign the Keep Washington Income Tax Free petition!