Related Articles

Relevant Topics

As the state begins developing new rules for the Washington capital gains income tax, various questions are being raised on the details of this new tax and how to apply the domicile rules correctly.

One of the biggest questions that has arisen is how Washington defines domicile. While the rules are still being drafted, tax attorneys at Lane Powell have created an eight-page checklist of factors related a taxpayer’s domicile.

While it would seem excessive to need an eight-page list, the domicile rules by the Department of Revenue are very presumptive of Washington domicile and require significant proof on the taxpayer's part to prove they are no longer domiciled in the state. This creates complex scenarios for taxpayers.

As noted in the article:

“With respect to gains from the sale of tangible personal property, if the property is moved out of Washington at least two years prior to the sale of the property, the gains will not be allocated to Washington. In this case, the two years include the current taxable year and the immediately preceding taxable year.”

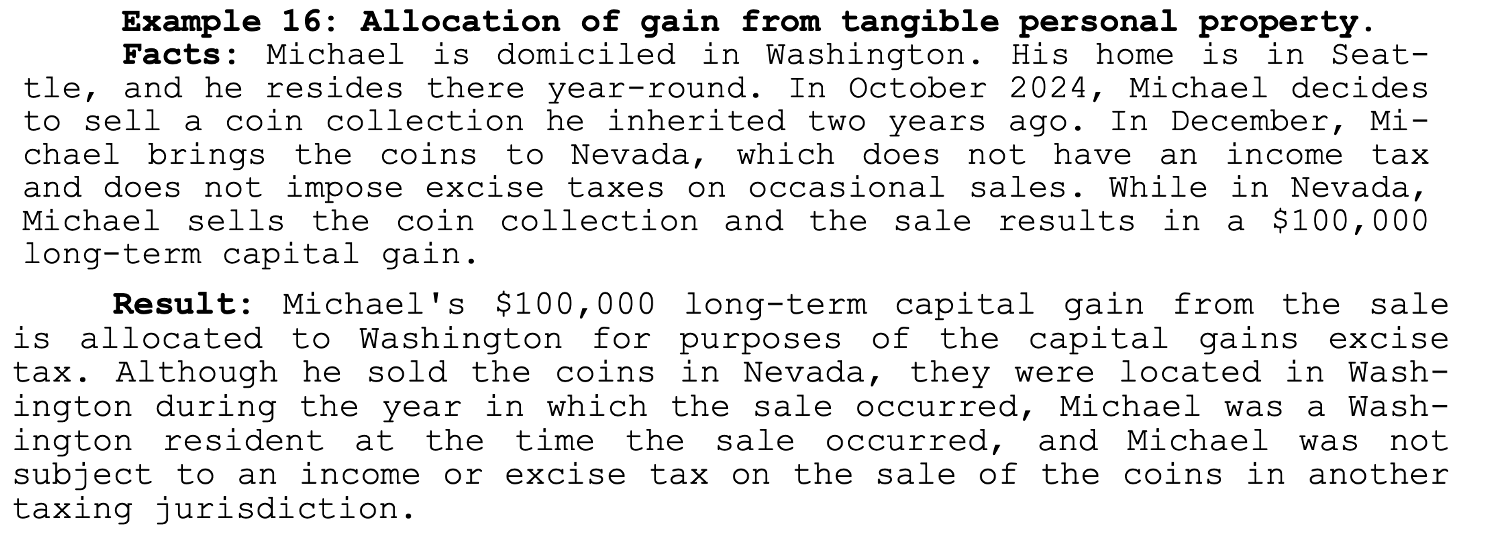

The example cited in the initial rulemaking was a Washington-domiciled resident selling coins in Nevada.

For the above example, to not incur the capital gains tax, the coins must be moved out of the state for two years before being sold. How Washington can apply an “excise tax” on a transaction outside its borders remains to be answered.

The guidance for clearing this domicile hurdle is complex. Per the authors:

“The key to an easy/favorable resolution in allocating long-term gains from intangible property is clear and convincing evidence that you have abandoned your Washington domicile with the burden on the party asserting the change, which is usually the taxpayer. To change domicile, a taxpayer not only needs to leave Washington but also must establish a new domicile. Completing this checklist and maintaining (in readily accessible files) evidence of all actions taken, including printouts of computer pages and emails, can help with both the assessment of the taxpayer’s domicile and carrying the burden of proof if there is a dispute with the tax authorities.”

The article and checklist can be found here.