Related Articles

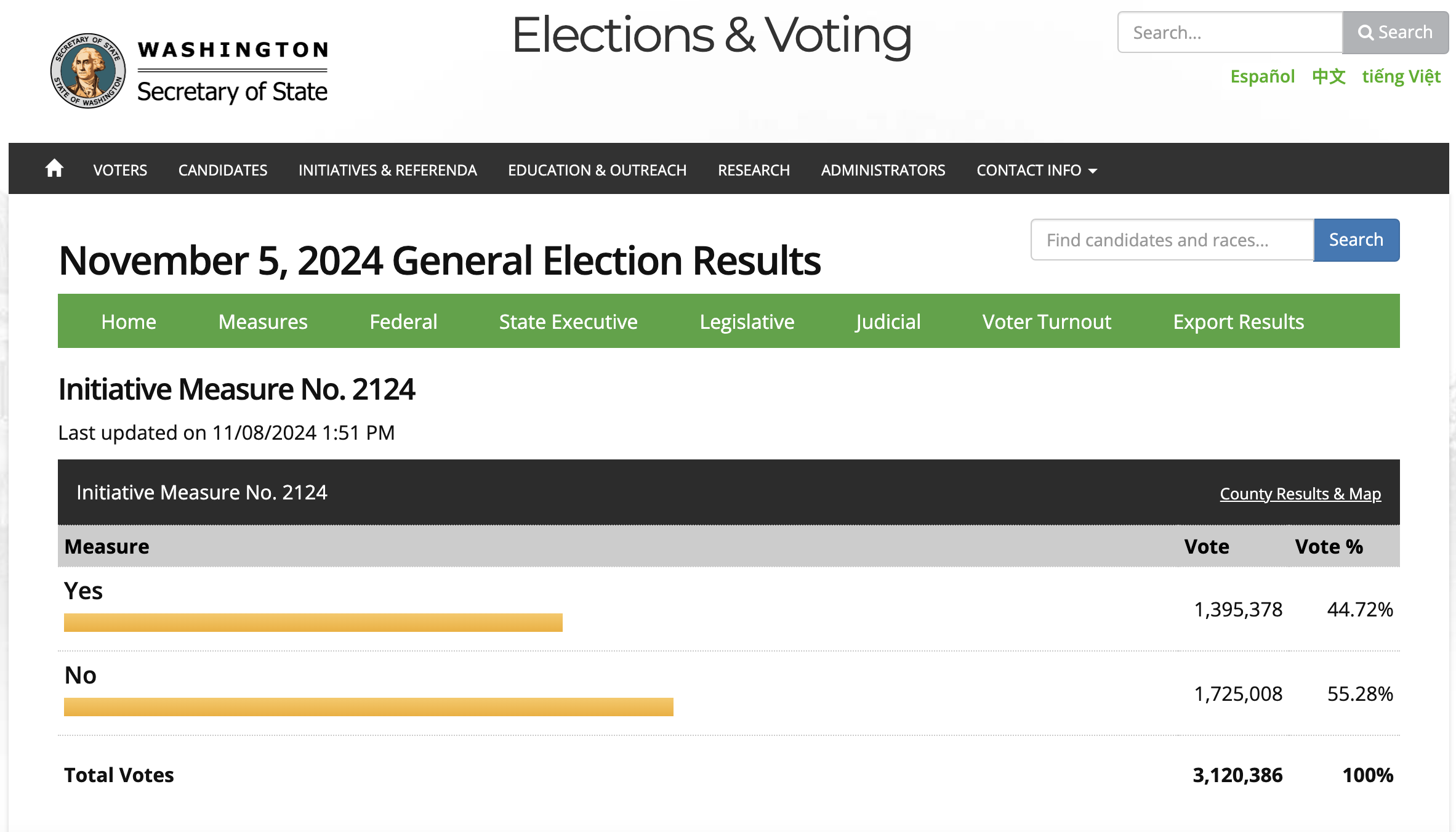

In voting down Initiative 2124 on Election Day, Washington state voters decided it was OK to keep forcing low-income wage earners to pay for the possible life needs of middle- and upper-income Washingtonians. That’s what the state’s mandatory WA Cares program will do, much like the state’s paid-leave fund already does.

By benefitting a minority of workers with up to 18 weeks of taxpayer-paid time off work from the Paid Family and Medical Leave (PFML) program, all other workers in Washington state are harmed with a burdensome payroll tax that keeps growing. By the way, my research shows it is most often workers who are not in financial need of taxpayer dependency who take advantage of the program. PFML is not a safety net.

Neither is WA Cares.

While it’s true that some people in need of long-term care someday might gain a $36,500 benefit from WA Cares, it’s also true that many won’t. And a taxpayer-provided safety net for people in financial need already exists in Medicaid. That amount is also inadequate for long-term care. Washingtonians will want to do some saving and planning outside of WA Cares.

Taxpayer dollars that will be eventually given out through WA Cares will need to be spent on state-approved long-term-care services. Those who become eligible for the benefit will not only have to need long-term care as the state outlines, most will need to have paid into the fund for at least 10 years without a break of five or more years. They will also need to have worked a certain number of hours in each of those years.

The WA Cares payroll tax rate is 58 cents on every $100. That could increase. The tax rate for PFML has more than doubled in its short lifetime, from .40% in 2019 to .92% beginning in 2025.

Between the two payroll taxes for PFML and WA Cares, a person who made the state’s average annual income in 2022 will have about $1,000 dollars taken from his or her paychecks each year. Employers will also pay into PFML on an employee’s behalf. Calculate your payroll taxes for WA Cares and PFML here.

Money that could be used by individuals and families to make ends meet — or saved and invested for life needs, including retirement or possible long-term care — is being redistributed and funding the administration of these misguided programs.

In addition to WA Cares staying mandatory, I-2124's failure will have some lawmakers seeing a message of affirmation from voters. Remarks from Gov. Jay Inslee and Democratic House Speaker Laurie Jinkins are early indications. I won’t be surprised to see the Legislature consider additional or increased payroll taxes on workers.

Writers for The Washington Observer said in post-election analysis that state budget writers might not need to make the tough fiscal choices this year that were expected after the Economic and Revenue Forecast Council announced revenue for the state through 2029 dropped by about $39 million. “Maybe instead of chopping the budget,” they wrote, “lawmakers in the Democratic majority can grow it.”

Tolerance for taxes that were on the ballot may inspire more of them. Watch your budget. Additional payroll taxes could be coming to a paycheck near you.