Related Articles

Policymakers have added a provision for a Road Usage Charge (RUC) to the $15 billion Senate transportation tax package known as Forward Washington (Senate Bill 5483). The provision implements a RUC by imposing it on owners of electric and hybrid vehicles – a narrow application that nonetheless opens the door for expansion of the tax to all vehicles in the future.

The language directs that by July 1, 2026, electric and hybrid vehicles would pay a RUC of two cents per mile. In June of 2029, that rate would increase to two and one-half cents per mile. This would replace the $150 electric vehicle fee and the $75 transportation electrification fee that EV owners pay now when they renew vehicle registrations, as those fees would be repealed that same year. Drivers who wish to pay a RUC sooner could do so through an early adoption program that would begin in 2025 and could have their EV fees waived.

Money collected from a RUC would be deposited into the Motor Vehicle Fund and used for preservation and maintenance. Though money in the fund is protected for highway purposes only, future legislatures could easily replace it with a different account and divert money to non-highway projects. For the money to be protected with the higher level of certainty as the gas tax is, it is critical that any per-mile charge explicitly be protected under the state constitution’s 18th Amendment, which protects public money for highway purposes only.

The proposed RUC language not only bypasses the 18th Amendment debate but appears to oppose it. It calls for “specific recommendations to better align the system with other vehicle-related charges and potentially establish the framework for broader implementation of a per mile funding system, including analysis of the preferred method for addressing 18th amendment restriction considerations.” This leaves the door open for RUC money paid by drivers to be diverted to non-road related spending like public transit.

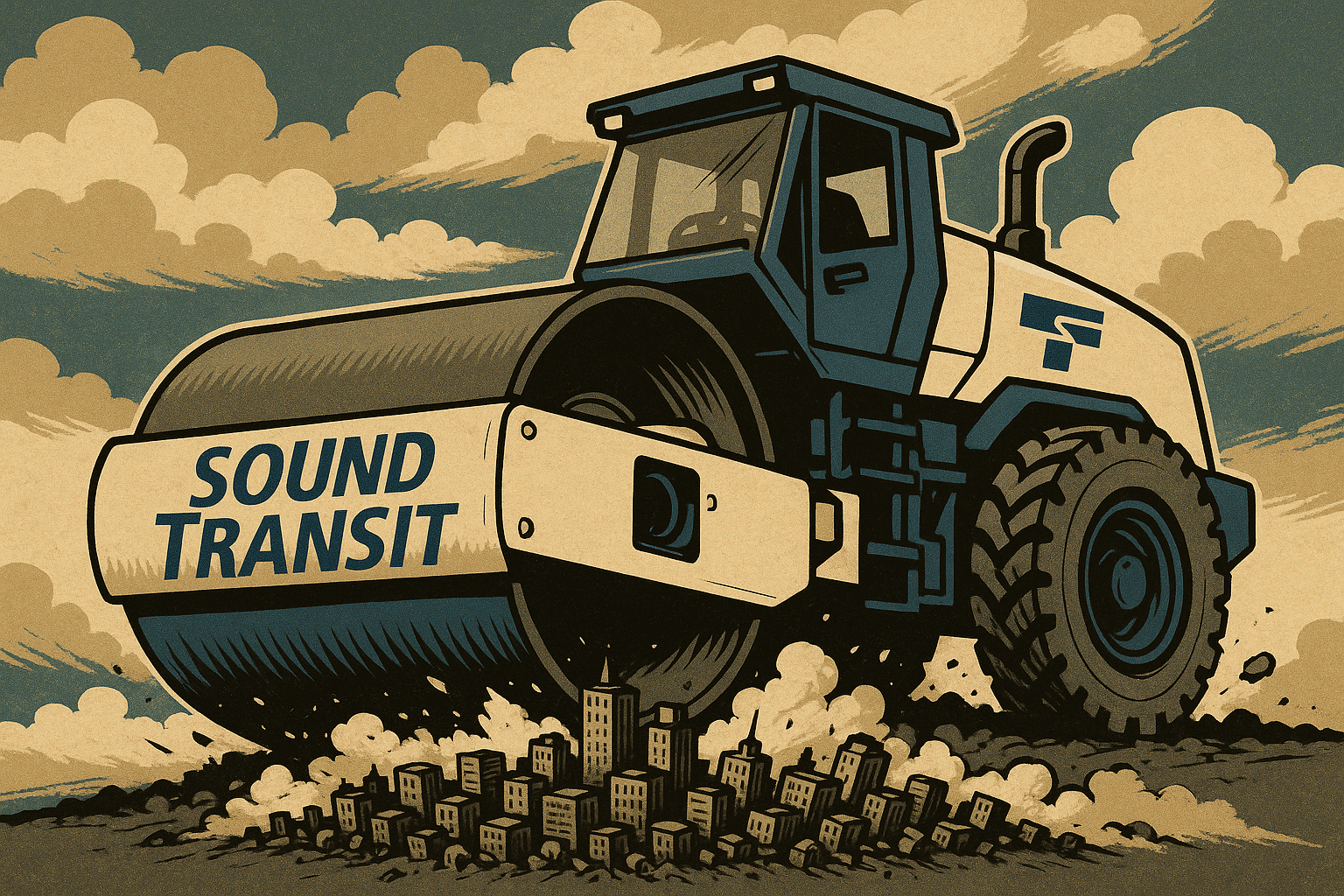

A stand-alone RUC bill (Senate Bill 5444) was introduced earlier in the legislative session but has failed to pass out of committee. Implementing a RUC as a part of a large transportation tax package despite that is a political choice that circumvents a robust public debate on the merits and detriments of this massive policy change.

The RUC is a substantial change to the way Washington drivers would pay for transportation infrastructure in Washington state and should require a more transparent legislative process than a budget proviso that is buried deep in a budget document. Any RUC implementation should be in a stand-alone bill that lawmakers can debate and directly vote on.